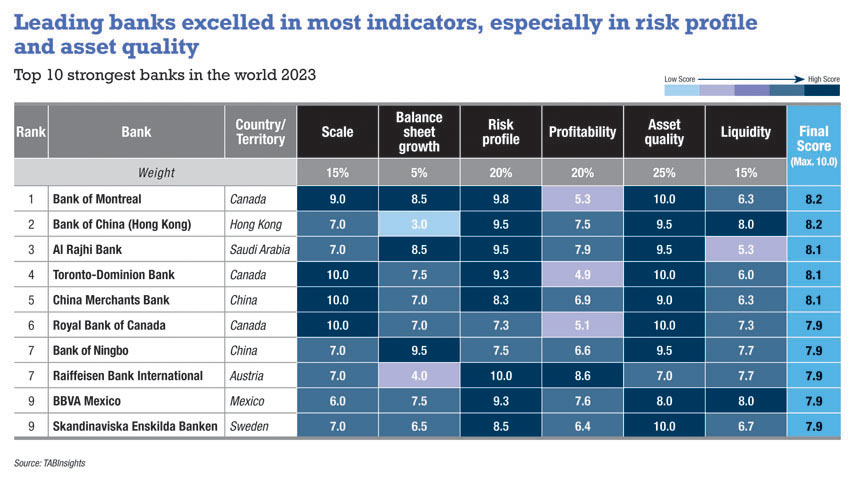

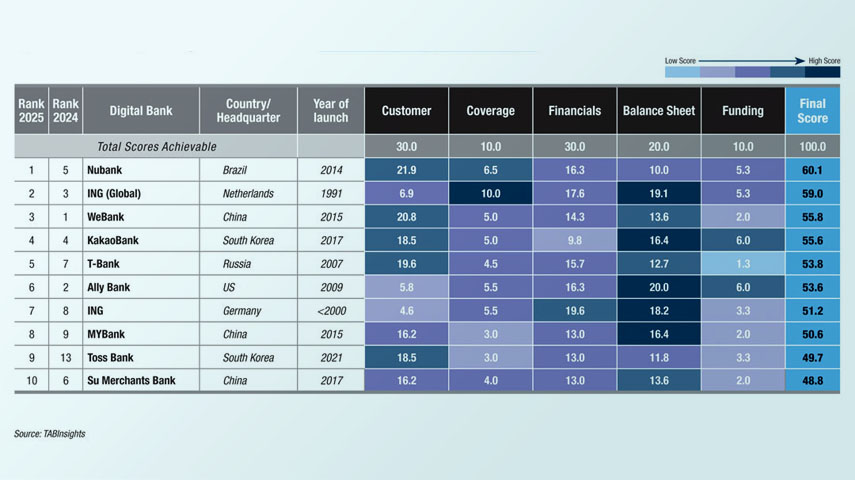

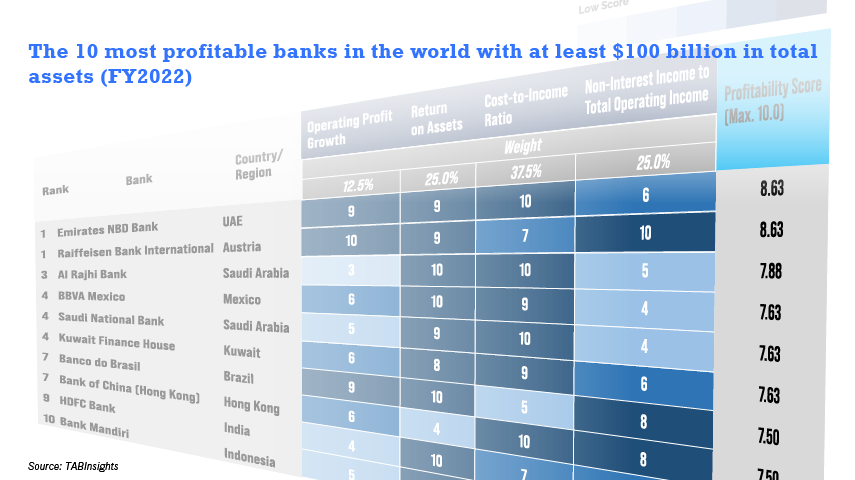

The TABInsights Islamic Banks Rankings highlight stronger financials in Middle Eastern banks, particularly in Saudi Arabia, Kuwait and the UAE, while Asian institutions remain smaller and less profitable. Islamic banks are strengthening balance sheets amid evolving risk and governance priorities.

.jpg)