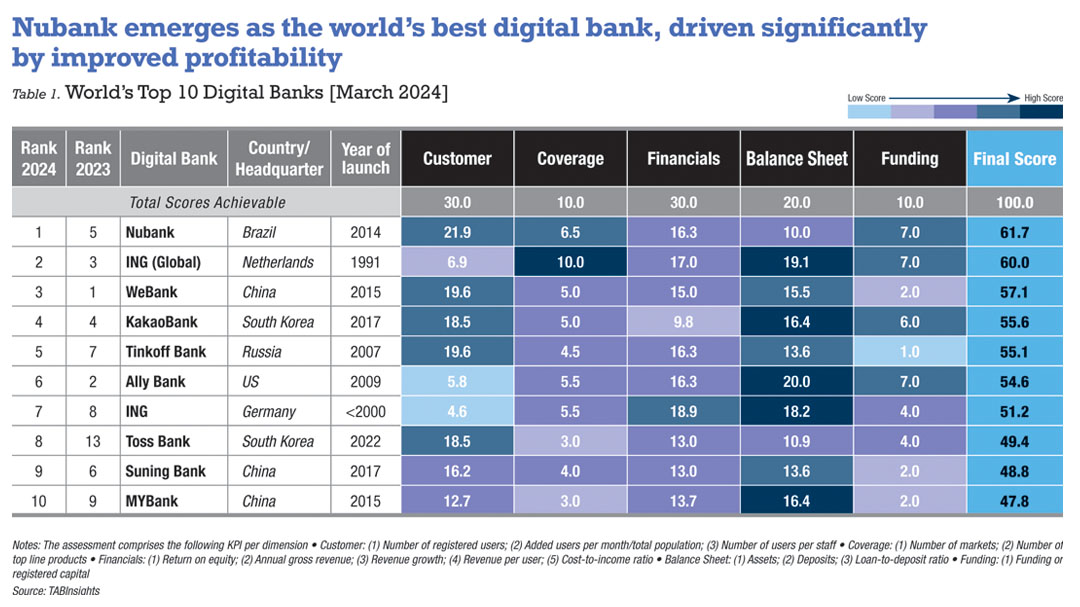

Nubank climbed from 10th to first position in the World’s Top 100 Digital Banks Ranking since 2022, setting a global benchmark for digital banks by balancing profitability with customer satisfaction and efficiency. The Digital Banks Ranking focuses on the most successful first- and second-generation digital banks that operate independently of traditional commercial banks. The assessment evaluates capabilities across five key dimensions: customer experience, market and product coverage, profitability, balance sheet, and funding.

In this year’s ranking, the world’s top 10 digital banks collectively held $1.4 trillion in total assets and $1.2 trillion in customer deposits. The average loan-to-deposit ratio for these banks increased from 72% in 2022 to 76% in 2023. Nine out of the top 10 digital banks were profitable, except for Toss Bank, which achieved its first breakeven in the third quarter of 2023. The average return on equity (RoE) for these 10 banks, calculated as pre-tax profit divided by equity, stood at 24%. These banks generated approximately $49 billion in annual revenue in 2023, a notable increase from $41 billion in 2022. Their revenue per user ranged from $10 to $809, with a cost-to-income ratio (CIR) varying from 21% to 54%.

Nubank revolutionised Latin America’s financial sector

Nubank disrupts traditional banking inefficiencies in Latin America with its digital, customer-centric model, first launched in Brazil and gradually expanding into Mexico and Colombia. Adopting a multi-product strategy around 2020, Nubank witnessed explosive user growth, reaching 93.9 million users in 2023, with 94% in Brazil, nearly tripling from 33.3 million in 2020. It serves as the primary banking choice for over 61% of its monthly active customers.

Nubank jumped from fifth place in last year’s ranking to first, primarily attributed to improved profitability. In 2023, the bank achieved a significant milestone by turning profitable, with $1 billion in net profit, compared to the $0.4 billion loss in 2022. Despite this being its first profitable year, Nubank’s ROE stood at an impressive 27%, ranking fourth among the world’s top 10 digital banks. Its total operating income surged by 85% in 2023, driven by 119% growth in net interest income and 28% increase in fee and commission income. Furthermore, its average revenue per user rose to $67, surpassing WeBank’s $15.

The bank demonstrated strong operational efficiency, improving CIR from 66% in 2022 to 36% in 2023 with just a 1% increase in total operating expenses. The users-per-staff ratio also significantly improved as the bank added an average of 1.6 million customers monthly in 2023 while reducing staff from 8,000 to 7,700.

Nubank displayed robust credit risk management with significant operating income growth and a record 10.2% risk-adjusted net interest margin in the fourth quarter of 2023, despite higher non-performing loans. Additionally, the bank stood out in customer satisfaction, achieving a Net Promoter Score of 90%.

Toss Bank expanded through customer-centric products and services

Launched in October 2021, Toss Bank made significant strides in the ranking of digital banks, climbing from 13th in last year’s ranking to eighth place. Despite being a late entrant to the digital banking scene, Toss Bank has emerged as a leading force in South Korea’s digital banking sector, leveraging cutting-edge technology to enhance customer experience and streamline operations. The bank excelled in innovative product offerings, including its Interest First Time Deposit and daily interest payments, emphasising its commitment to customer empowerment and satisfaction. This is made possible by its advanced digital infrastructure.

Toss Bank expanded its customer base from 1.1 million in 2021 to 8.9 million in 2023, propelled by innovative products and promotions. It secured the highest users-per-staff ratio among the world’s top 10 digital banks outside China. Moreover, its operating income surged by over 600% in the first nine months of 2023. Its lean operation significantly contributes to cost efficiency, reflected in its 39% CIR during the same period, leading to its first quarterly break-even in the third quarter of 2023.

Digital banks such as ING (Global) and WeBank have remained the prominent players in the global digital banking arena. The retail arm of the ING Group, with the largest asset size, excelled in market and product coverage, financials, and balance sheet performance. WeBank holds the largest user base among global digital banks, with over 377 million individual customers and more than 4.1 million micro, small, and medium-sized enterprises. Despite facing a slowdown, WeBank showcased financial resilience through robust operational efficiency and an impressive ROE.