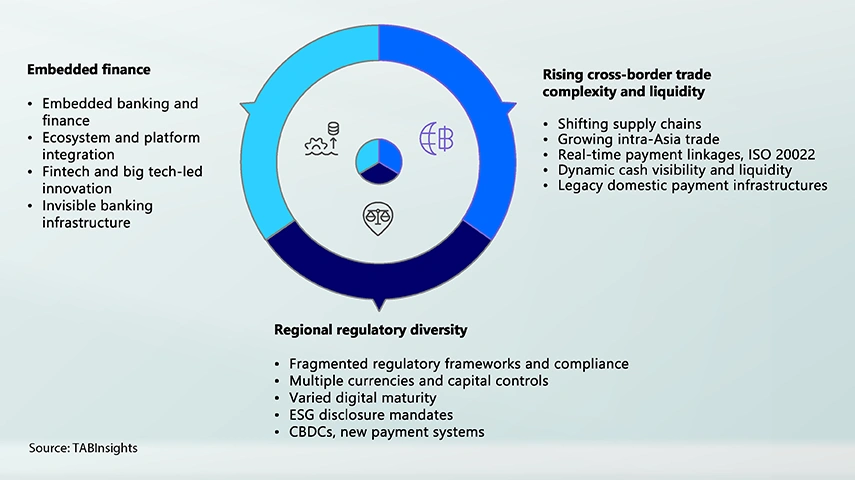

APAC banks redefine wholesale banking with intelligence, real-time liquidity and embedded ecosystems

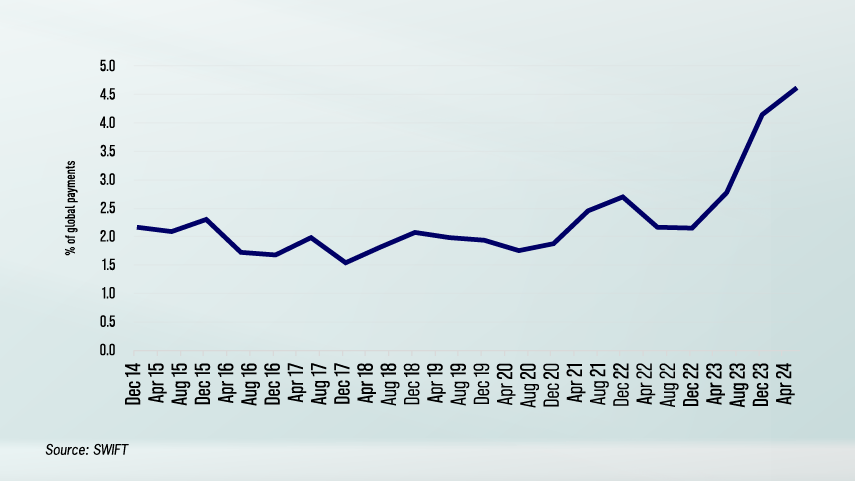

As Asia Pacific’s trade and payment flows accelerate, leading banks in the region are embedding finance into client ecosystems, orchestrating modular platforms and scaling AI for resilient, sustainable growth.

.jpg)