- Up to 80% of Russian foreign exchange transactions with global banks are denominated in US dollar.

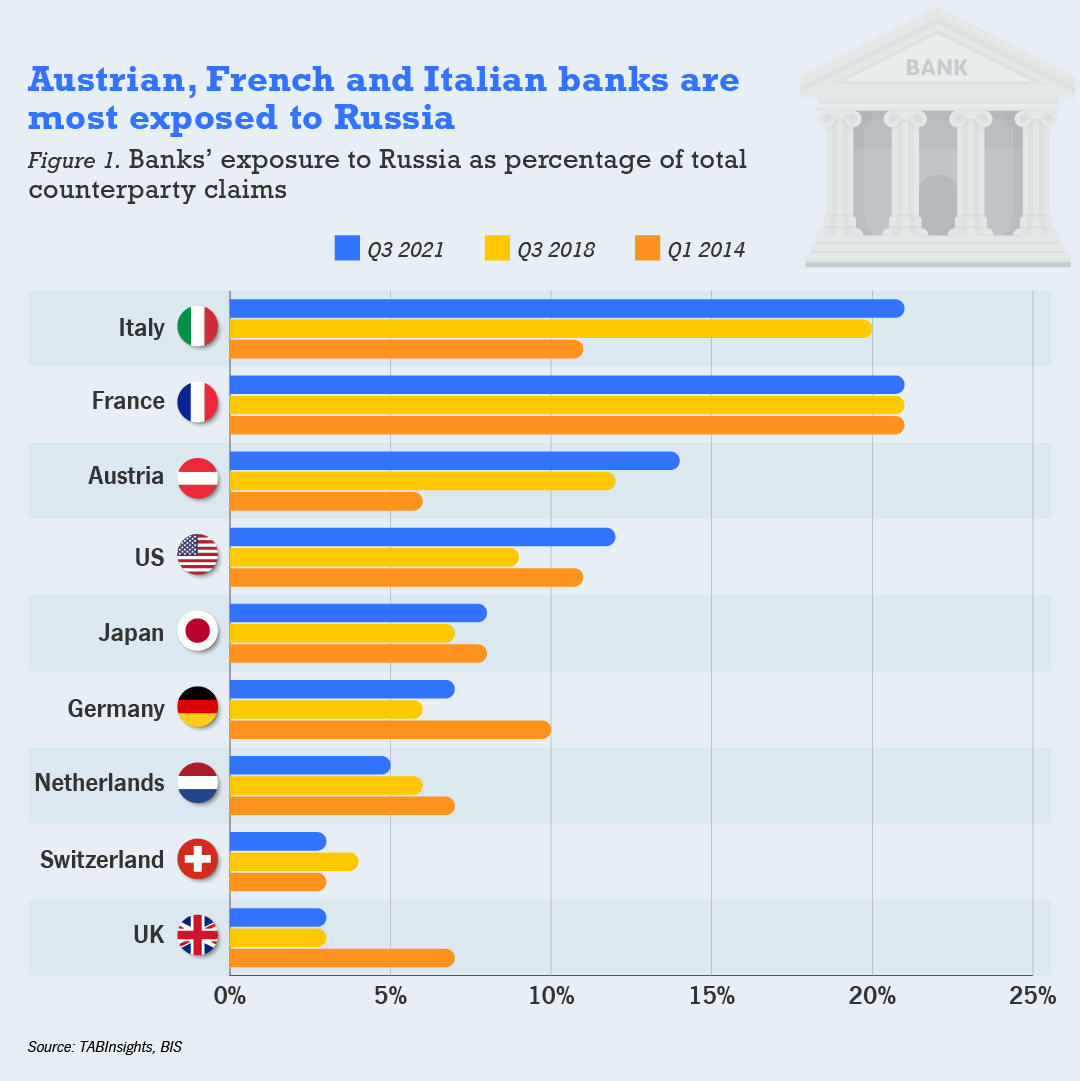

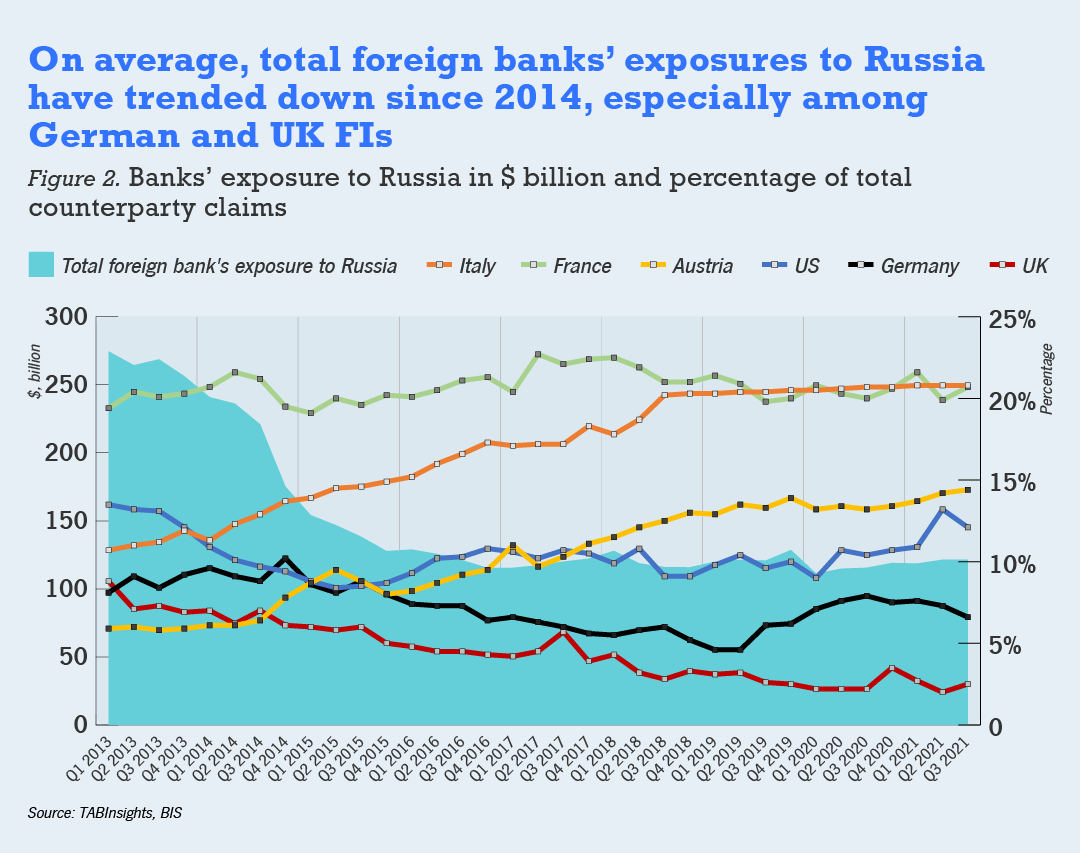

- Austrian, French and Italian financial institutions are most exposed to Russia while US’ exposure has increased steadily since 2015.

- The escalation of Russia’s attack on Ukraine will hasten decision to bar Russia from SWIFT.

In the wake of Russia’s attack on Ukraine, its financial institutions are facing a barrage of sanctions from the United Kingdom (UK), the United States (US) as well as the European Union member states and partners. The cumulative actions will also directly impact banks and FIs in countries that have significant exposure to Russia and its related interests. Data from the US Treasury shows that on a daily basis, Russian FIs conduct about $46 billion worth of foreign exchange (FX) transactions globally, 80% of which are denominated in US dollar.

The US Treasury’s action against Russia’s two largest lenders, Sherbank and VTB, which make up more than 50% of total industry assets will impact global correspondent banking flows, and by extension the ability of European and US companies and banks to process payments for Russian counterparties. While the Biden Administration is yet to bite the bullet on cutting the Russian financial system from the global payment messaging platform, SWIFT, the Treasury’s imposition of correspondent and payable-through account sanctions on Sberbank and full blocking sanctions on VTB will likely send ripples across global FIs. According to these directives, U.S FIs are required to close any correspondent payable-through accounts and reject any future transactions including any payments processed in US dollar once it hits a US FI. Blocking sanctions have also been imposed on three other major Russian financial institutions; Otkritie, Novikom, and Sovcom.

Data from the Bank for International Settlement (BIS) on total claims on an immediate counterparty basis shows that banks in Europe are relatively more exposed to Russia, however exposure of US banks also increased to 12.1%of total counterparty claims in the third quarter (Q3) of 2021 compared to 8.5% in Q3, 2015 as sanctions imposed on Russia’s annexation of Crimea began to take effect. European banks particularly in Austria, Italy and France are most exposed to Russia with Austrian banks’ exposures notably reaching 14% of total counterparty claims in Q3 2021 from 6% in Q1, 2014.

During Q3, 2021, banks in Italy and France held outstanding claims of $25.3 billion and $25.1 billion, followed by Austria which had $17.5 billion. Claims by banks in the US stood at $14.7 billion for the same period.

Relative exposure of total foreign banks however declined significantly from $240.9 billion in outstanding claims in Q1, 2014 to $121.5 billion during Q3, 2021. BIS data shows that lenders in Germany and UK have scaled back significantly on their exposures when compared to Q1, 2014.

The course of events and pace of escalation will determine whether the US, unilaterally or multilaterally with its European allies, decides to sever Russia’s link to SWIFT. The impact of a SWIFT sanction is however argued to be overstated given the availability of alternative digital and blockchain-based payment systems designed to reduce reliance on the US dollar. Any ban on Russian FIs from SWIFT will not only damage the Russian economy and financial system but also disrupt global payments and financial operations, making it harder for global creditors, investors and counterparties to receive money from Russian entities.