Saudi Arabia-based Al Rajhi Bank remains the world’s largest and strongest Islamic bank, according to the 2025 Largest and Strongest Islamic Banks Rankings. This comprehensive assessment evaluates the 100 largest Islamic banks and financial holding companies globally for the financial year (FY) 2023, with a cutoff date of March 2024.

The Middle East remains a key hub for Islamic finance, despite Asia having more Islamic banks in the ranking. Middle Eastern banks outperformed their Asian counterparts in scale, risk profile and profitability, while Asian Islamic banks demonstrated stronger asset quality. The ranking employs a detailed and transparent scorecard, evaluating Islamic banks across six dimensions of financial performance: balance sheet scale, growth, risk profile, profitability, asset quality and liquidity, encompassing 14 specific metrics.

Islamic banking is gaining global recognition for its alignment with environmental, social, and governance (ESG) principles. Rooted in Shariah law, it avoids interest-based transactions, promotes ethical practices like profit-and-loss sharing, and supports sustainability by prohibiting investments in non-compliant activities, and focuses on tangible assets. Islamic banks are increasingly integrating ESG principles, with initiatives like Pakistan’s green banking policy and Malaysia’s green technology financing scheme, that encourage Islamic banks to adopt ESG practices.

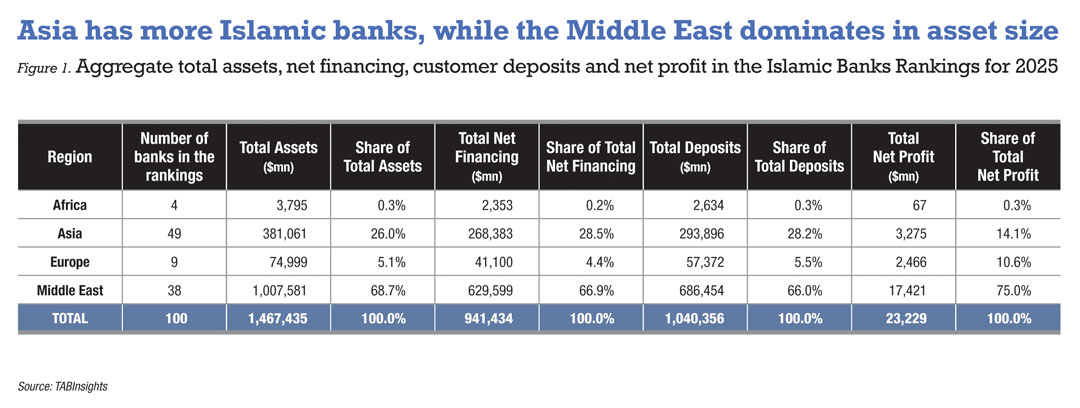

Middle Eastern Islamic banks lead in assets, despite Asia having more Islamic banks

The top 100 Islamic banks from 25 countries collectively held $1.47 trillion in assets, $941 billion in net financing, $1.04 trillion in customer deposits, and $23.2 billion in net profit in FY2023. This ranking includes 49 banks from Asia, 38 from the Middle East, nine from Europe, and four from Africa, focusing on banks with available financial data for FY2023. Islamic banks remain much smaller than their conventional counterparts, with only 34 surpassing the $10 billion asset threshold. In contrast, over 850 banks in the TAB Global 1000 ranking exceed this asset mark.

The Middle East remains a major hub for Islamic finance. While fewer in number, Middle Eastern Islamic banks account for 68.7% of the combined total assets of the 100 banks, compared to 26% for Asia. In net profit, Middle Eastern banks dominate with 75%, while Asian banks contributed only 14.1%. Saudi Arabia leads with 23.9% of total assets, followed by Malaysia at 17.9%, the United Arab Emirates (UAE) at 13%, Kuwait at 12.2%, and Qatar at 9.9%.

Islamic banks in the Middle East and Africa saw slower balance sheet growth in FY2023. In the Middle East, average asset growth fell from 10.3% in FY2022 to 8.8% in FY2023, excluding Kuwait Finance House, primarily due to slower growth in Saudi Arabia. In Asia, average asset growth declined from 12.7% in FY2022 to 7.4% in FY2023, influenced by reduced growth among Islamic banks in Malaysia, Bangladesh and Pakistan.

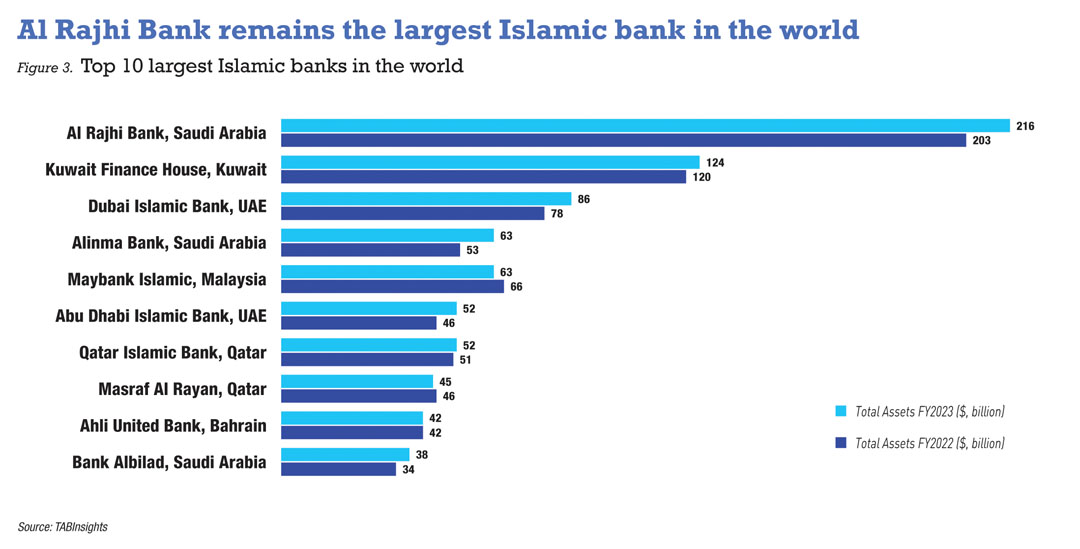

The top 10 largest Islamic banks globally include three from Saudi Arabia, two from the UAE, two from Qatar, and one each from Kuwait, Malaysia, and Bahrain. Al Rajhi Bank remains the largest with $216 billion in assets at the end of 2023, followed by Kuwait Finance House at $124 billion, 74% smaller. Ahli United Bank from Bahrain entered the top 10 after transitioning to an all-Islamic model post-acquisition by Kuwait Finance House. Saudi Arabia-based Alinma Bank surpassed Maybank Islamic as the fourth-largest, growing 18% to $63 billion in assets in 2023. Abu Dhabi Islamic Bank grew its assets by 14.4% in 2023, surpassing Qatar Islamic Bank and Masraf Al Rayan, which saw modest growth and asset declines, respectively.

.jpg)

In Asia, Malaysia, Indonesia, Pakistan and Bangladesh are key players in the Islamic banking sector. Malaysia, Indonesia, Bangladesh and Pakistan contribute 17, 12, nine and seven banks to the ranking, respectively. While Asia has more Islamic banks than the Middle East, many remain relatively small. The total assets held by Islamic banks in Bangladesh, Indonesia and Pakistan account for just 3.3%, 2.5%, and 1.5% of the total, respectively.

Maybank Islamic, with $66 billion in assets at the end of 2023, is the only Asian bank in the global top 10 largest Islamic banks. The top 10 Islamic banks in Asia include eight from Malaysia and one each from Bangladesh and Indonesia. Bank Syariah Indonesia, Islami Bank Bangladesh, Meezan Bank, and Bank Islam Brunei Darussalam— the largest Islamic banks in Indonesia, Bangladesh, Pakistan, and Brunei—hold $23 billion, $18 billion, $11 billion, and $8 billion in assets, respectively.

Islamic banking is also growing in Europe and Africa, with six Turkish banks, two from the United Kingdom (UK), and one from Germany included. Turkish banks hold 4.7% of total assets and 10.5% of net profit. In Africa, Algeria, Nigeria, South Africa and Sudan each has one Islamic bank represented.

Saudi Arabian Islamic banks continue to display the highest overall strength

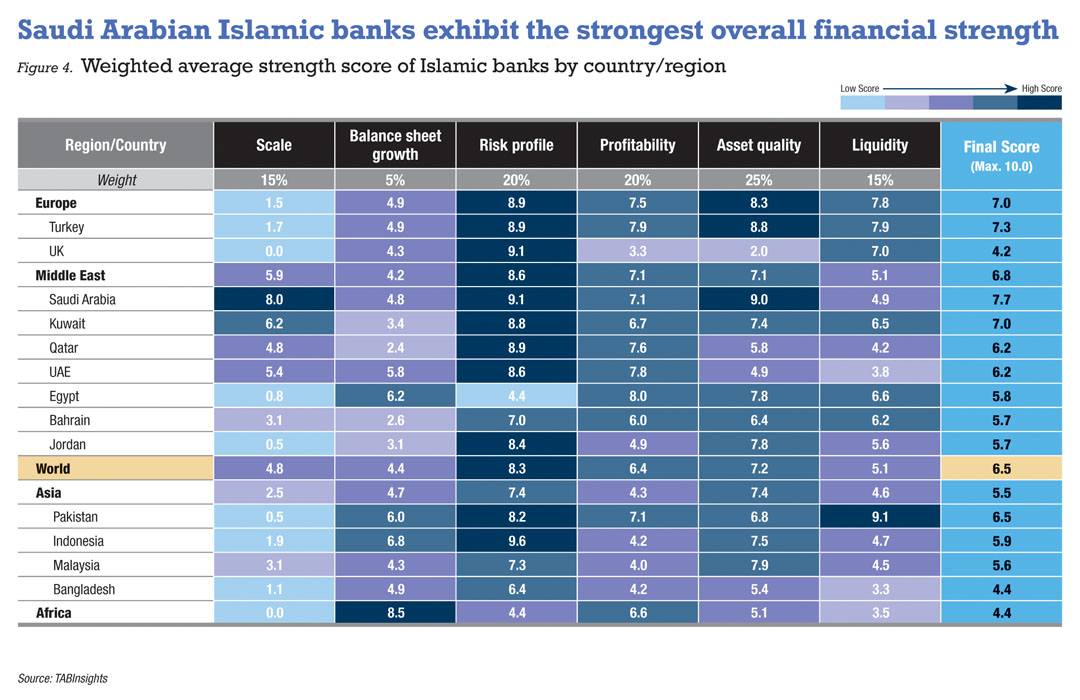

Despite slower balance sheet growth, the global Islamic banking sector showed improved overall performance in FY2023. The asset-weighted average strength score of the top 100 Islamic banks rose to 6.5 out of 10, up from 6.2 the previous year. The average return on assets (ROA) of these banks increased slightly from 1.59% in FY2022 to 1.64% in FY2023. Additionally, their average gross non-performing financing (NPF) ratio improved marginally, from 2.8% in FY2022 to 2.7% in FY2023. Europe achieved the highest strength score at 7.0, surpassing the Middle East, which scored 6.8. Meanwhile, Islamic banks in Asia and Africa posted average strength scores of 5.5 and 4.4, respectively, both falling below the overall global average.

Middle Eastern Islamic banks outperformed their Asian counterparts in terms of scale and profitability. In FY2023, the average return on asset (ROA) for Middle Eastern Islamic banks reached 1.8%, while Islamic banks in Asia reported a significantly lower average ROA of 0.9%. Additionally, the average cost-to-income ratio (CIR) for Islamic banks in Asia stood at 48% in 2023, notably higher than the 34% recorded by Middle Eastern banks. However, Asian Islamic banks excelled in asset quality, with an average gross NPF ratio of 2.4% in FY2023, compared to 2.9% for Middle Eastern Islamic banks.

Saudi Arabia, Turkey and Kuwait recorded the highest average strength scores, at 7.7, 7.3, and 7.0, respectively. Saudi Arabian Islamic banks excelled in asset quality, with an average gross NPF ratio of 1.1% and an average provision coverage ratio of 192%. These banks also demonstrated strong capitalisation, with an average capital adequacy ratio (CAR) of 20.2%. Their profitability remained robust, as reflected in an average ROA of 2% and an average CIR of 33%.

However, Saudi Arabian Islamic banks underperformed in liquidity compared to Islamic banks in Turkey and Kuwait. The average liquidity coverage ratio (LCR) for Islamic banks in Turkey and Kuwait reached 231% and 168%, respectively, surpassing the 125% reported for Saudi Arabian Islamic banks. Turkish Islamic banks also demonstrated higher profitability, with an average ROA of 3.5% and a greater contribution from non-financing and investment income. However, the average CIR of Turkish Islamic banks was 39%, higher than that of Islamic banks in Saudi Arabia. Turkish authorities have set a target for Islamic banks to capture 15% of total banking sector assets by 2025, up from 8.5% in September 2023.

In Asia, Pakistani Islamic banks demonstrated greater overall financial strength compared to their counterparts in Indonesia and Malaysia. Their profitability was particularly significant, with an average ROA of 2.2% in 2023, surpassing 1.4% for Indonesian Islamic banks and 0.8% for Malaysian Islamic banks. Additionally, Pakistani Islamic banks maintained robust liquidity, with an average LCR of 258% and net stable funding ratio of 167%.

Indonesian Islamic banks, however, exhibited stronger capitalisation, achieving an average CAR of 25.1% in 2023, higher than the 19.2% of Malaysian Islamic banks and the 16.6% of Pakistani Islamic banks. Malaysian Islamic banks excelled in scale and asset quality, with an average gross NPF ratio of 1.6%.

Al Rajhi Bank excels in profitability, capitalisation and asset quality

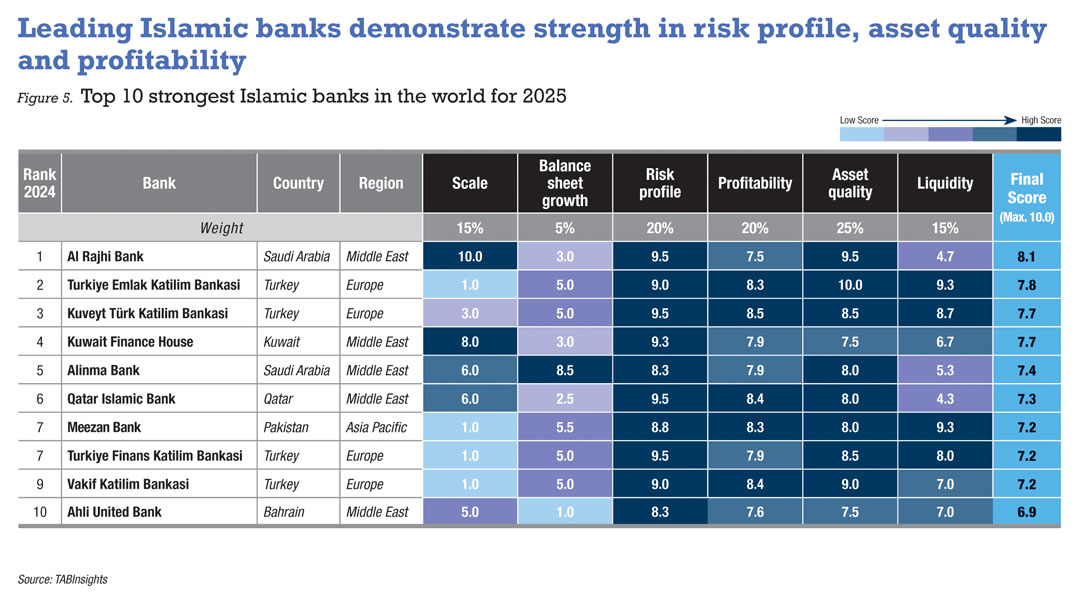

Most of the top 10 strongest Islamic banks globally performed well in risk profile, asset quality, and profitability. Al Rajhi Bank retains its position as the strongest globally, with an overall strength score of 8.1, followed by Turkey-based Turkiye Emlak Katilim Bankasi and Kuveyt Türk Katilim Bankasi. Kuwait Finance House and Qatar Islamic Bank rank fourth and sixth, respectively, while Pakistan’s Meezan Bank secures the seventh position.

Al Rajhi Bank demonstrated strong profitability, capitalisation and asset quality. The bank maintained a solid capital position, with a Tier 1 capital ratio of 20.4% and a CAR of 21.5%. Its asset quality remained robust, with a gross NPF ratio of 0.7% and a high provision coverage ratio of 203%. Despite a 3% decline in net profit, resulting in a drop in ROA from 2.5% in 2022 to 2.1% in 2023, its ROA remained strong. The bank’s CIR stayed low at 27%, well below the global average of 38%. However, it underperformed in liquidity, with its LCR falling from 126% in 2022 to 117% in 2023.

Kuwait Finance House posted stronger profit growth, a higher non-financing and investment income-to-total income ratio, and stronger liquidity compared to Al Rajhi Bank. However, despite improvements in asset quality and capitalisation, it still lagged behind Al Rajhi Bank in both metrics. Qatar Islamic Bank outperformed both Al Rajhi Bank and Kuwait Finance House in profitability, with its ROA rising from 2.1% in 2022 to 2.3% in 2023. Qatar Islamic Bank is also the most efficient Islamic bank globally, improving its CIR from 17.4% in 2022 to 17.1% in 2023.

In Asia, Meezan Bank, Bank Syariah Indonesia, and Maybank Islamic rank as the top three strongest Islamic banks. Meezan Bank excelled in profitability, capitalisation and liquidity, while Bank Syariah Indonesia stood out in balance sheet growth, and Maybank Islamic demonstrated strength in scale and asset quality.

Both Meezan Bank and Bank Syariah Indonesia improved profitability in 2023, while Maybank Islamic saw a decline. Meezan Bank’s ROA rose significantly from 2% in 2022 to 3.1% in 2023, outperforming Bank Syariah Indonesia’s 1.8% and Maybank Islamic’s 0.9%. Meezan Bank improved its CIR from 34.3% in 2022 to 28.8%, lower than Maybank Islamic’s 38.3% and Bank Syariah Indonesia’s 52.9%. Meezan Bank’s CAR rose from 18.6% in 2022 to 22.5% in 2023, outperforming Bank Syariah Indonesia (21%) and Maybank Islamic (17.8%). However, Maybank Islamic reported a lower NPF ratio of 1.1%, compared to Meezan’s 1.7% and Bank Syariah’s 2.1%. Islamic banking is expanding globally, driven by rising demand and innovation.

To view the rankings of the largest/strongest Islamic Banks, click here:

https://tabinsights.com/ab100/largest-islamic-banks

https://tabinsights.com/ab100/strongest-islamic-banks