- Banks redefining data management strategies to enhance business

- Chinese financial institutions quick to adopt AI because of potential

- AI is most used in lending, core banking infrastructure, and compliance

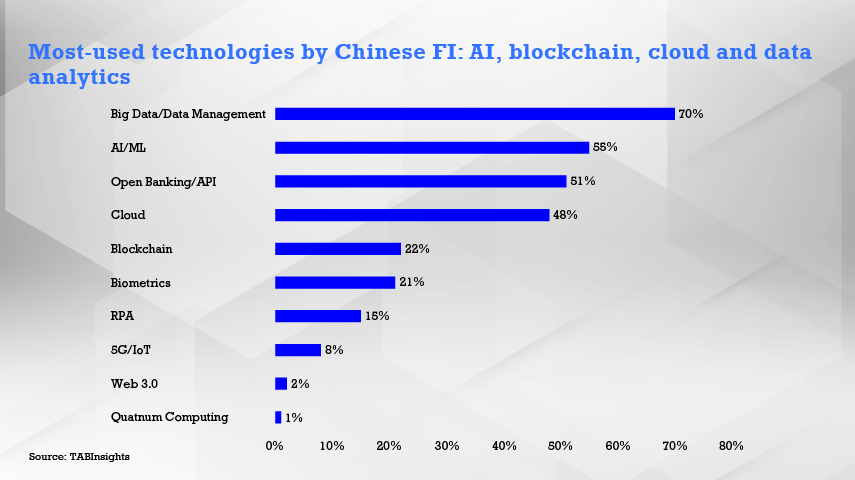

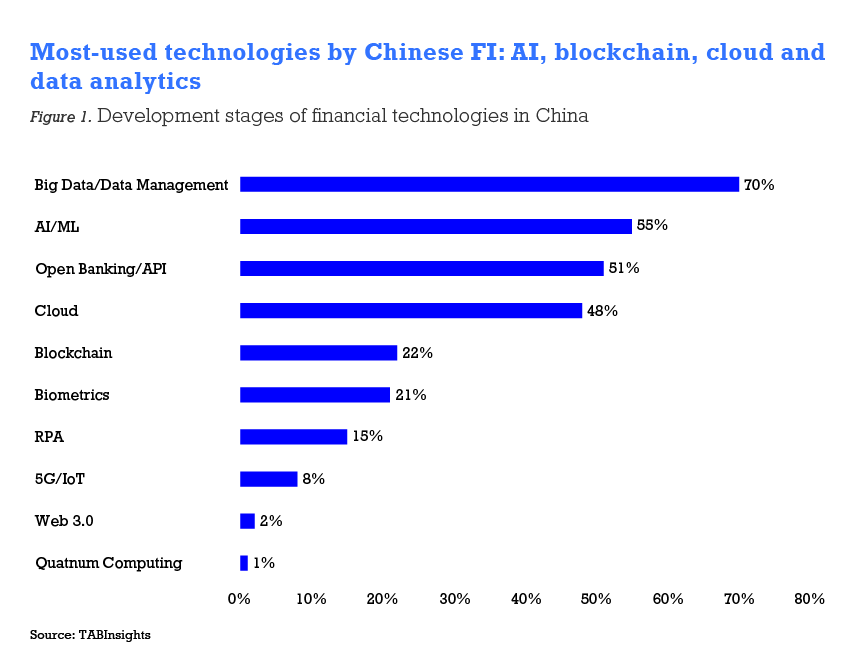

Financial institutions in China are reshaping their data management strategies and methods and are exploring new uses for AI in lending, creating agile core systems, and having more efficient compliance and regulatory tools.

Source: TABInsights

Banks redefining data management strategies to enhance business

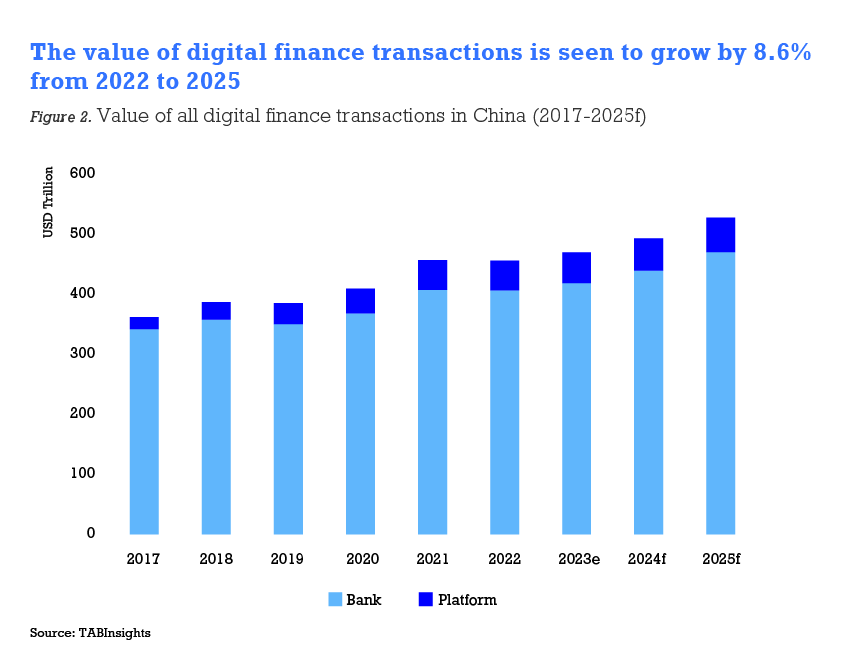

Banks in China are changing their approach to data management and analytics to gain an edge in the digital economy. Digital finance is estimated to make up more than 90% of all financial products and services in China by 2025.

Source: TABInsights

To take advantage of this opportunity, banks are upgrading their data management and analytics tools to help them understand the market better. These improvements are aimed at building integrated, agile and in-house data solutions.

An example of this development is ICBC’s data management middle platform. This integrates the data lake, data warehouses and the bank’s group information databases, and shares bank-wide data upon the three layers of sources, aggregation, and extraction. To better manage these data assets, ICBC created a data asset knowledge map that connects diverse types of data assets including source data, indicators, data services, and customer tags, and clarifies the relationship between data assets.

ICBC added machine learning (ML) in the platform to support data governance, connect with external data sources, and cross-check the data quality. The bank uses the platform in precision marketing, risk management, and decision making. Since its launch, it has helped the bank acquire 1.4 million new retail customers and 900,000 new corporate customers, and avoid potential losses of over RMB 10 billion ($1.40 billion).

While other financial service providers may be seen to be slower than banks in developing data tools, there are outliers like China Merchants Securities that works with multiple information technology vendors for data integration, cleansing, standardisation, and governance. It operates a unified marketing and operation platform for personalised recommendations and customer journey management. Together, these data management initiatives created a frictionless experience for its 16 million customers and encouraged the highest login times per day among security apps.

Less successful cases in the financial industry have often focused on a specific business line and come up with a standalone solution for it without considering the whole picture. The most common pain point among financial institutions in communicating data is the slow and complicated data sharing across business lines and departments. Now, as data assets will also be included in the balance sheet from 2024 onwards, acquiring, governing and maintaining data in their best quality would be a long-term goal for banks and other financial institutions.

Chinese financial institutions quick to adopt AI because of potential

Chinese financial institutions are adopting AI rapidly because of its immense potential to spur business and economic growth. “By the end of this decade, AI could be potentially delivering 26% increase in GDP [gross domestic product] for China,” said Chris Holmes, member of the UK House of Lords, and Science and Technology Committee, during his opening keynote at Future of Finance China 2023.

The leading bank in AI modelling development is China Construction Bank through its Tianquan AI Platform. It offers extensive features across perceptive, cognitive, and generative AI, earning it a Level-4 AI platform rating from the China Academy of Information and Communications Technology.

The platform has various capabilities such as financial image-recognition and video-recognition, that has significantly improved efficiency and accuracy. Its AI traders have also reduced transaction processing time by 90%, and its smart recommendation feature boosted the click-conversion rate for marketing activities by over 200%. In terms of business impact, the Tianquan platform reduced inaccuracy and shortened processing time. It also helped the bank achieve 200% growth rate in user conversion.

Other than AI platform development, Chinese banks are also increasingly adopting AI-backed service chatbots. In this, WeBank leads other banks, having deployed one of the most advanced conversational AI bots in the banking industry. WeBank’s smart customer service robots handle over 95% of customer conversations with 90% accuracy rate. It also manages various financial services, including personal and business loans, auto loans and deposits. Banks that are less advanced in this field still predominantly rely on scripted, rule-based chatbots to enhance operational efficiency, but WeBank provides a more interactive and hyper-personalised customer experience.

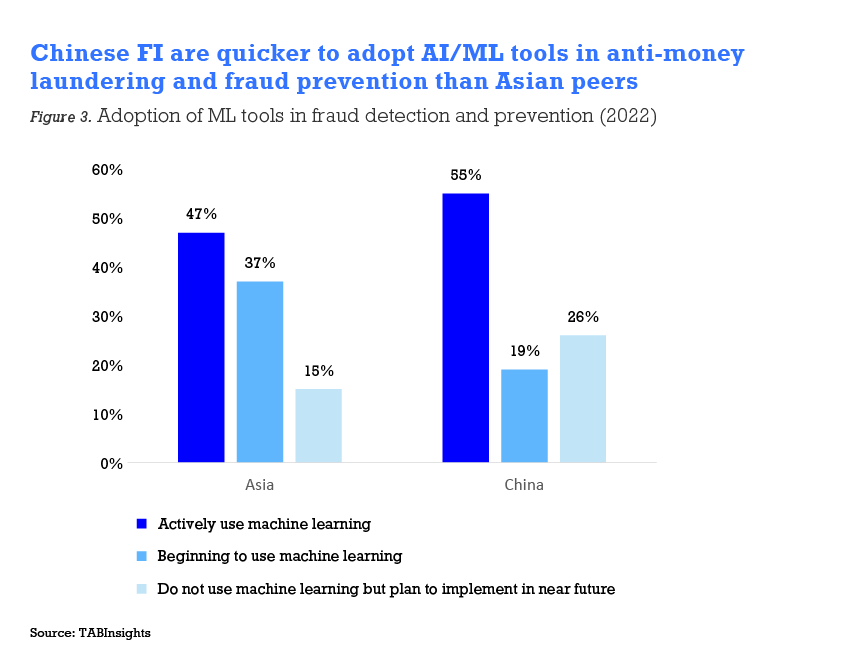

Panelists at Future of Finance China 2023 concurred that AI and ML can assess risks and aid in anti-money laundering procedures. However, these technologies also face challenges related to data privacy and sharing. Technologies like privacy-preserving computation and federated learning can help address these concerns and are gaining support from policymakers. Some external parties are willing to share data and resources with the public large models, but it requires addressing conflicts of interest and the privacy of specialised knowledge. To achieve broader and more effective applications, integrating AI with domain expertise will be essential.

AI is most used in lending, core banking infrastructure, and compliance

Chinese banks are increasingly using open banking and analytical capabilities to cut down credit evaluation time. Digital customer ecosystems and pre-trained AI models are also used to increase credit approval conversion rates and lower delinquency rates.

In collateral-free lending for small and medium enterprises, banks use AI and dynamic enterprise knowledge graphs to set a credit limit. For broader business lending, Bank of Beijing uses central bank credit, tax data, and other available public data, combined with independently developed models, algorithms, and strategy applications to reduce credit risks. With this, the bank can provide active risk monitoring and early warning that identifies risks as early as 10 months in advance.

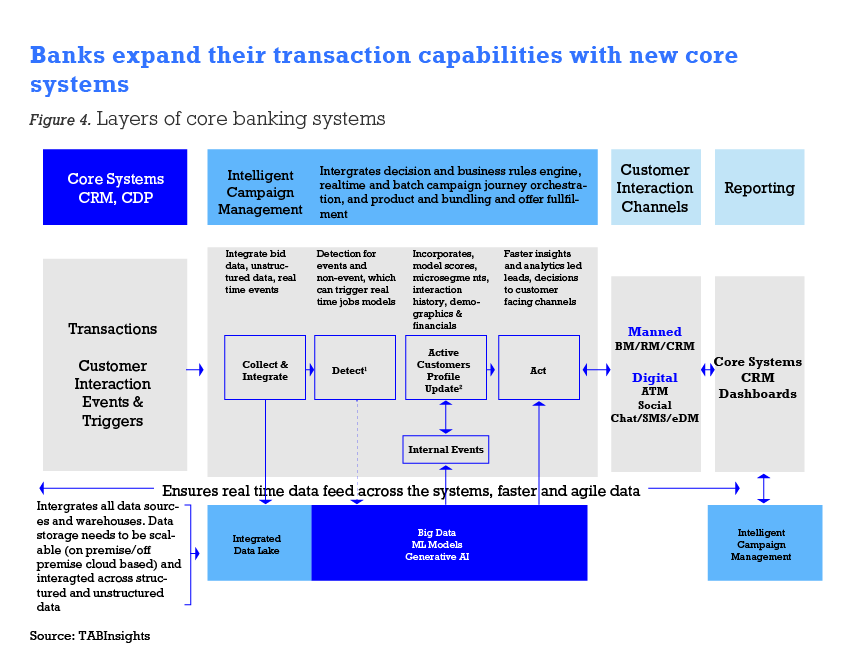

Smaller banks are also breaking through their technology barrier by working with leading vendors on core banking infrastructure. For example, Bank of Qinhuangdao, a small city commercial bank, worked with Shenzhou Info on building its new core system to resolve issues on tight coupling, low componentisation, and high development costs caused by the old system. The new core is more robust and agile with a processing capacity of 2,000 transactions per second. Among larger banks, China Construction Bank has deployed 25% of its dispersed core banking system on the cloud. Since the cloud migration, the total cost per transaction has been reduced by 50% to 70%, and the physical servers, and hardware and software costs for branches and subsidiaries have decreased by two-thirds.

Source: TABInsights

In compliance, meanwhile, banks are streamlining the end-to-end auditing process both online and offline, and also standardises the compliance process by using internal modeling tools. Leading regional banks can reduce the time of deploying new models from one day to two hours and the non-onsite auditing man-days from 1,000 to 300. Large FI such as China Pacific Insurance promote interconnection with its subsidiaries.