Thailand is on the brink of a major digital banking transformation, with the first three digital banking licences set to be issued in early 2025. This move signals a significant shift in Thailand's financial landscape, as it joins other Southeast Asian nations in embracing digital banking.

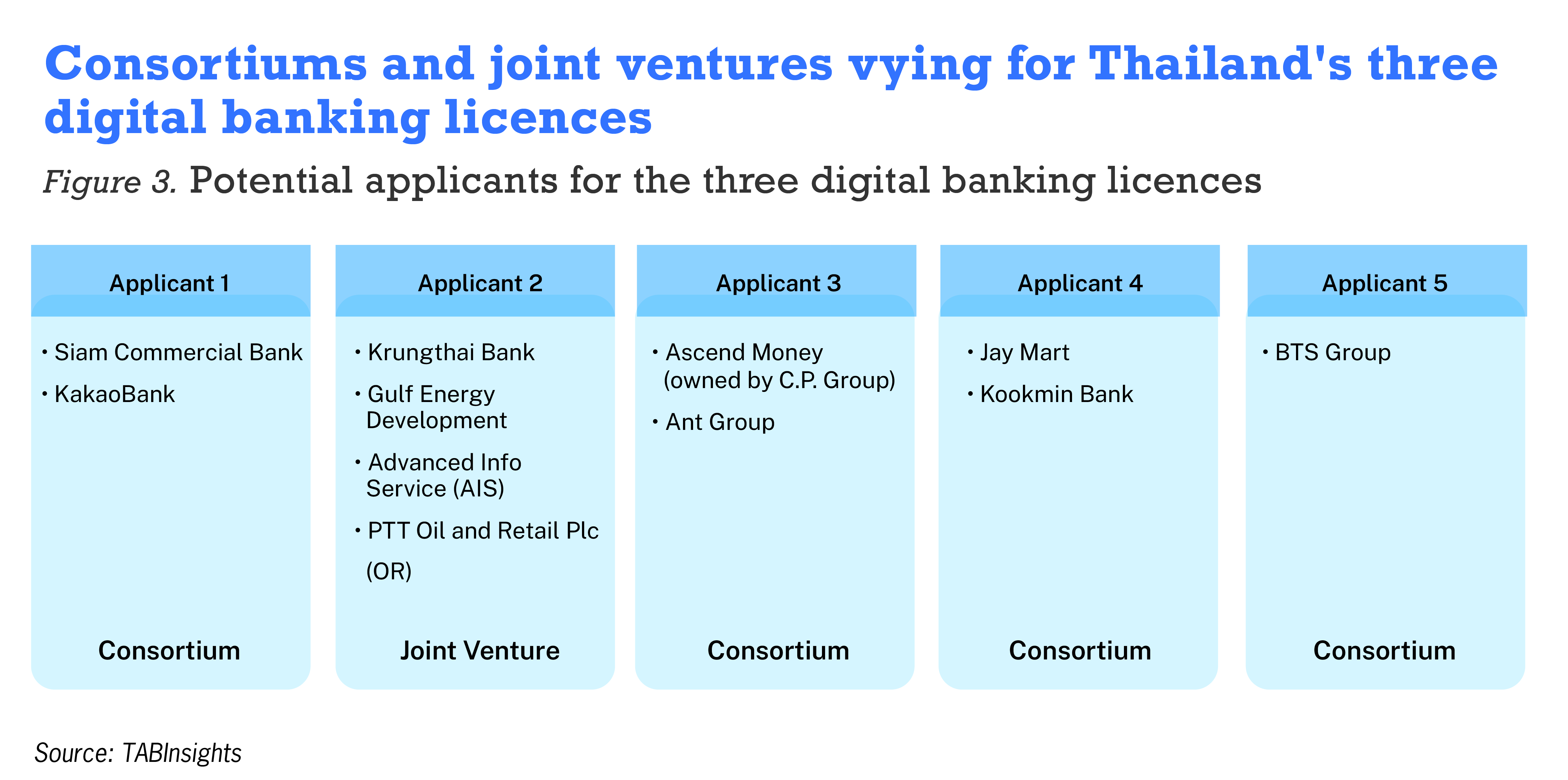

Five major consortiums and joint ventures, involving local tech, retail, energy, and transportation groups, are vying for these licences. However, many traditional banks perceive the digital banking licence as a potential limitation within the Thai market due to regulatory and operational challenges.

TrueMoney, operated by Ascend Money and owned by the influential Charoen Pokphand Group (C.P. Group) in partnership with Ant Group, is viewed as the most significant threat to existing banks. Its established market presence and technological capabilities make it a formidable competitor.

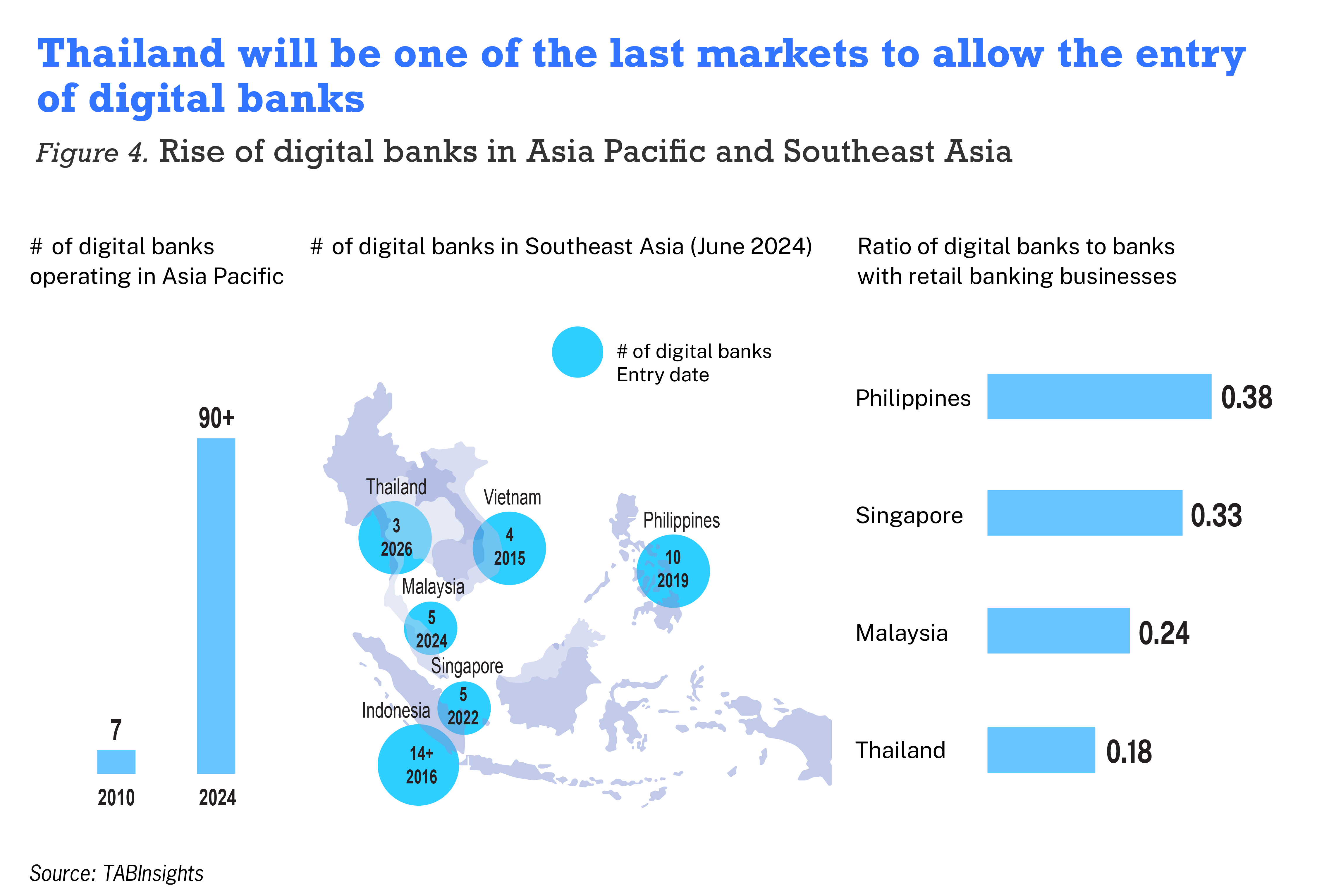

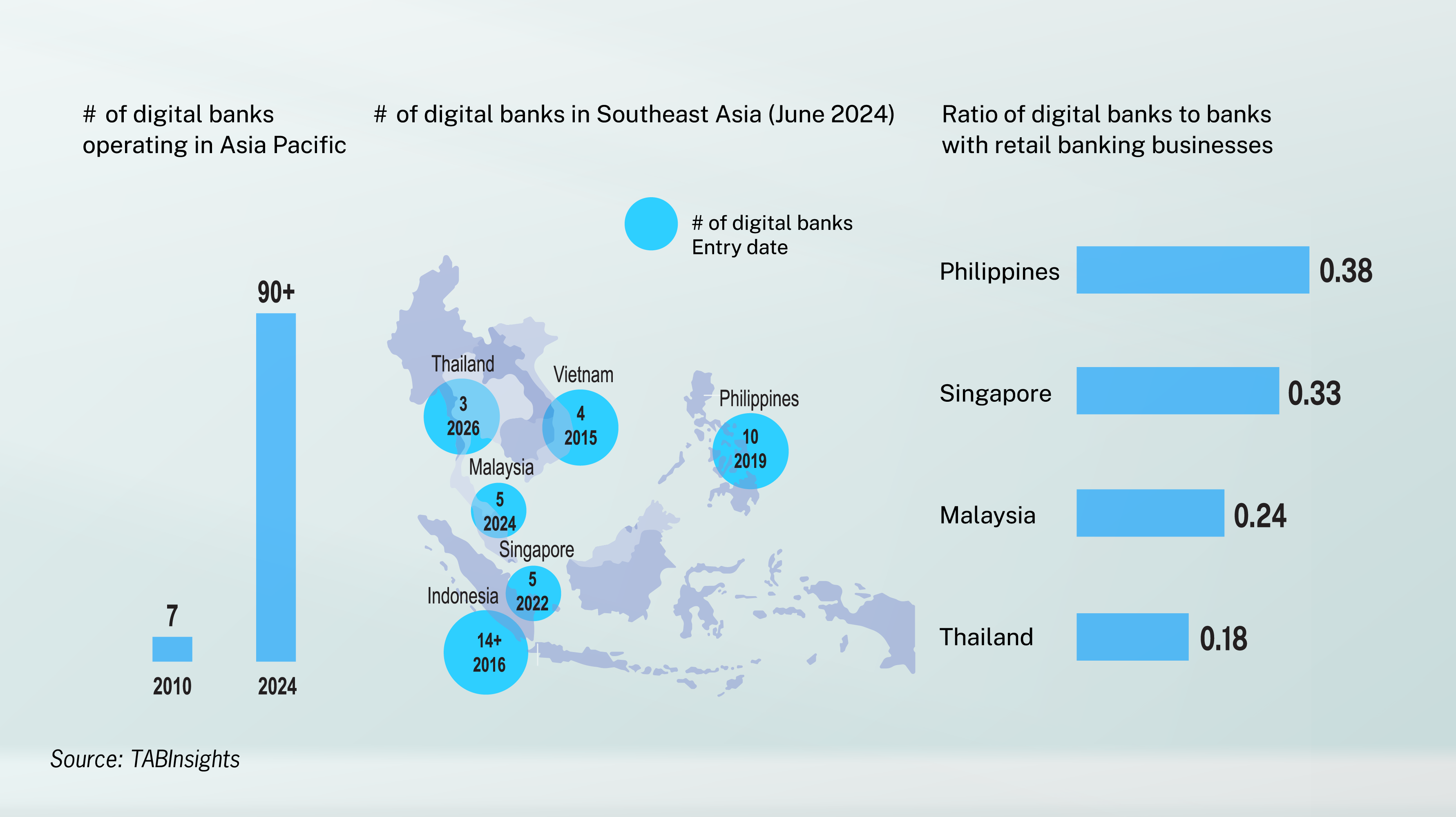

Thailand joins Asia as a hotbed for digital banks

Asia remains a hotbed for new digital bank entrants. Although the peak period for mobile-centric digital banks was between 2017 and 2022, countries like Malaysia, Philippines, South Korea, Thailand and Vietnam are expected to witness further entries in 2024 and 2025. Thailand, one of the last Southeast Asian countries to issue digital banking licences, is expected to do so in as early as the first quarter of 2025.

Target segments for digital banks in Thailand

According to the latest 2020 financial inclusion survey by the Bank of Thailand, 99.7% of Thai households had access to financial services.

As of 2024, approximately 34% of Thailand’s population, or 25 million people, live in rural areas. Millennials and Gen Zs make up 43% of the population, or 31 million people, representing a substantial opportunity for digital banking services. In SME financing, the estimated total funding gap for the more than three million SMEs is at least $30 billion, excluding trade finance. The Bank of Thailand (BOT) believes these segments can be better served by digital banks.

However, most banks including the smaller ones, regard the digital banking licences as a constraint in the Thai context, due to customers’ preference for branch banking, the high minimum capital and the associated technology requirements.

Regulatory and licensing challenges

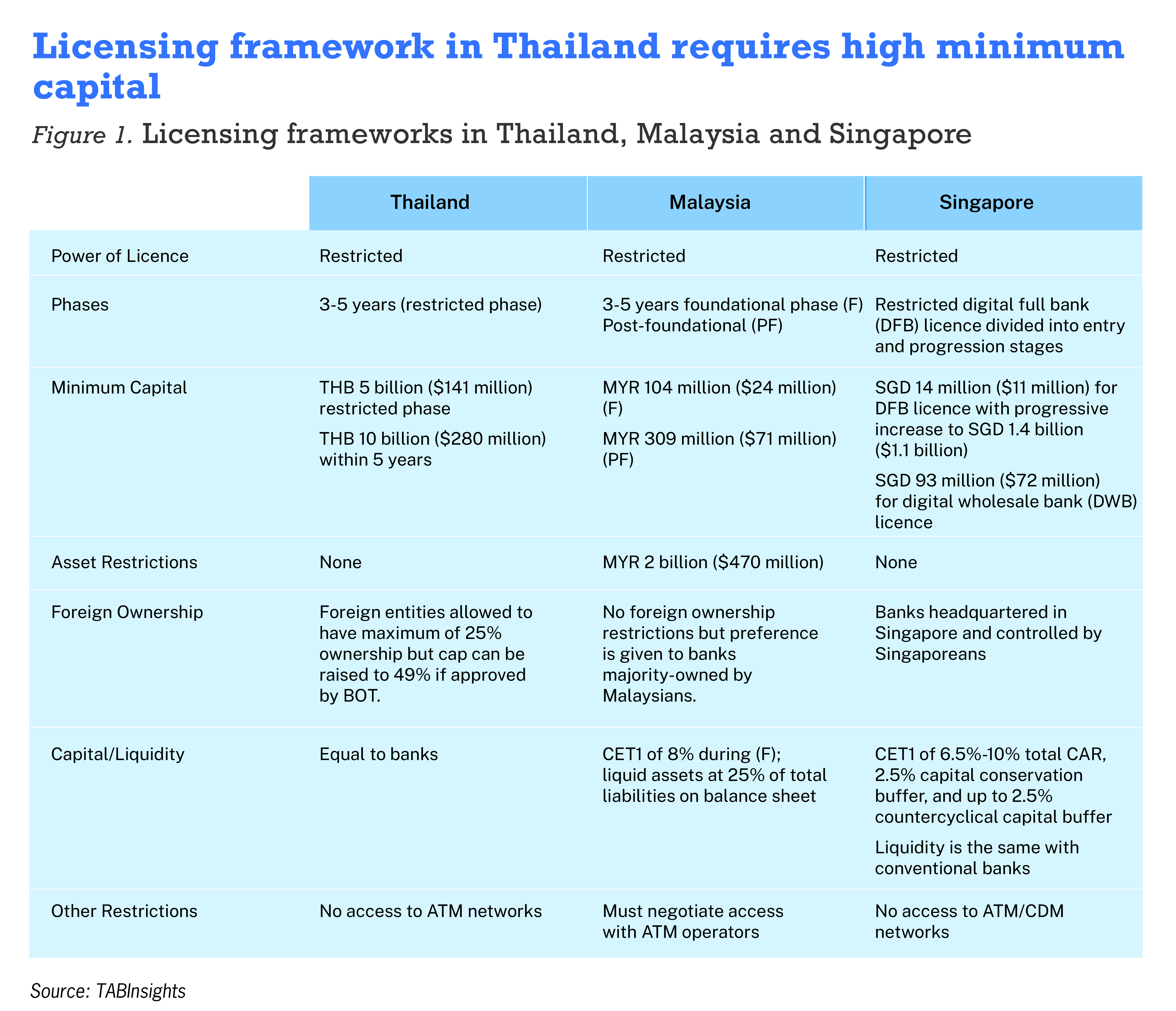

Thailand's digital banking licensing framework presents significant barriers to entry. It is in line with certain aspects of the frameworks in Singapore and Malaysia, such as no restriction on asset size or special liquidity requirements. However, the higher minimum capital requirements for both the initial phase and post-restricted phase of THB 5 billion ($141 million) and THB 10 billion ($280 million), respectively significantly higher than both countries.

The Bank of Thailand framework imposes a similar three up to five years restricted phase. Despite the explicit mandate to encourage provision of financial services to SMEs, BOT has not opted to issue a specific wholesales licence like Singapore.

In addition, BOT mandates that digital banks must have at least one director and chief technology officer (CTO) with a minimum of three years of experience in IT or digital services. The CTO must work full-time for the virtual bank and may not be employed by another legal entity.

Access to banks’ ATM network remains restricted too for the digital banks, although they may offer cash-in and cash-out services by appointing banking agents or pooling ATMs with other providers.

They must also ensure business continuity and continuous availability of IT services and operations, with no disruptions or outages exceeding eight hours per year, and ensure full service and operation recovery within two hours of any disruption.

Branch banking continues to dominate in Thailand

Despite the shift towards digital services, branch banking continues to dominate in Thailand, perceived to be preferred by more affluent customers. Today, all banks emphasise branch coverage across locations to cater to the needs of customers. While over 70% of retail banking customers are active mobile users, between 60% and 70% of retail sales continue to come from the branch network.

Timeline and profitability

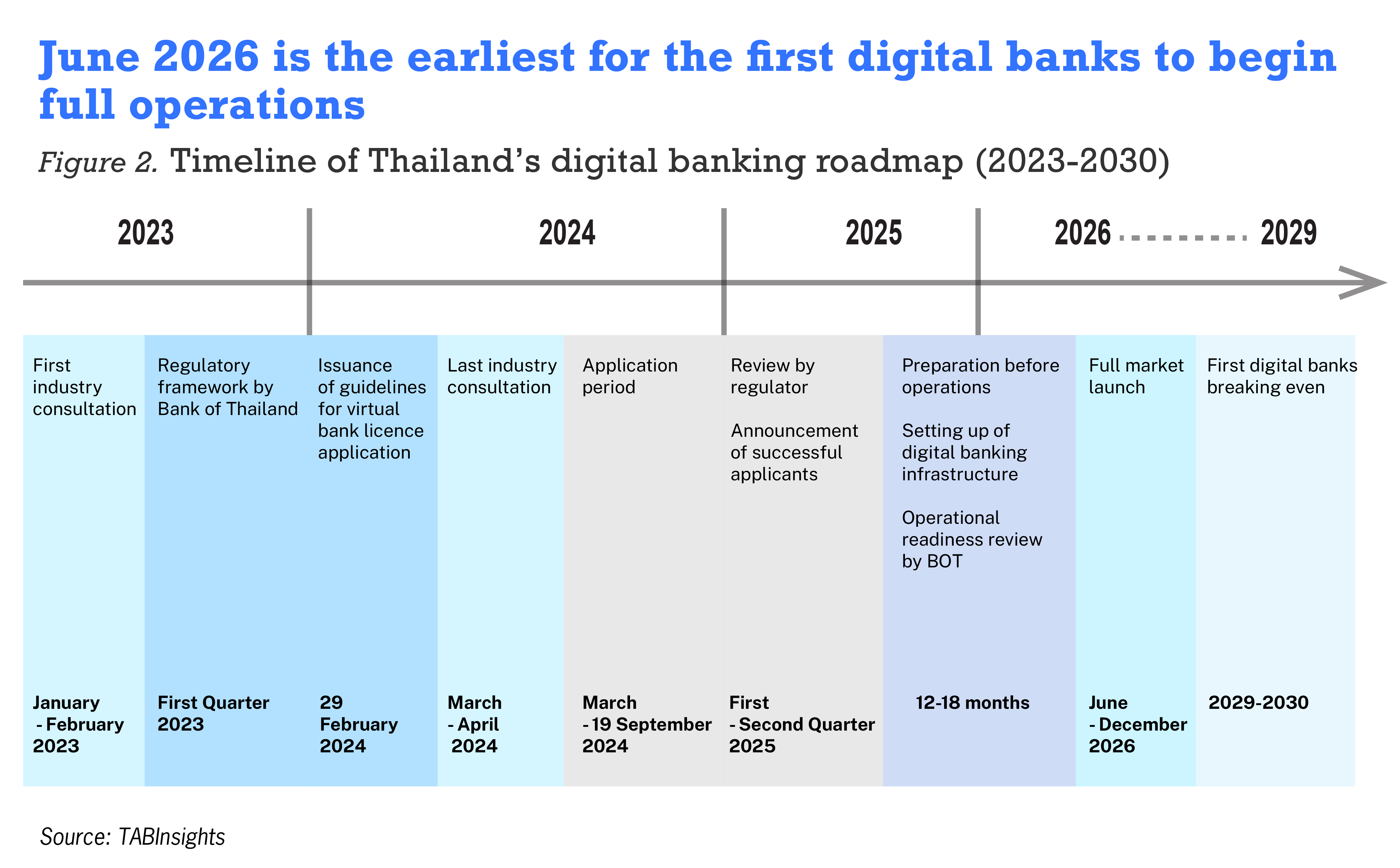

Given the uncertainty surrounding whether successful bidders will be able to adhere to the one-year schedule in Thailand, it is expected that the first digital banks could go to market between the second and fourth quarters of 2026.

Bank of Thailand stipulates that digital banks must commence operations within 12 months after the issuance of the licence. This period does, however, include the time needed by BOT to certify operational readiness, which is believed in the industry to take up to 12 months. Hence, the 12-month target is seen by many in the industry as overly ambitious.

However, BOT highlighted that it can make exemptions and allow the virtual banks to commence operations after one year of receiving approval from the Ministry of Finance if deemed necessary.

In comparison, Maya Bank in the Philippines launched six months after it received its licence, though preparation might have started earlier. GXBank in Malaysia, led by Grab, received its digital banking licence from Bank Negara Malaysia (BNM) in April 2022. The bank was certified operationally ready on 1 September 2023 in a span of 490 days, or 16 months. Given a three- to four-year path to profitability for the most successful digital banks today, this gap also provides sufficient time for incumbents to fortify their position, close the gap in customer experience and modernise their front and backend infrastructure.

Profile of applicants for three digital bank licences in Thailand

Currently, five leading consortiums and joint ventures intend to bid for the licences. Like with most digital banks in Asia, consortiums and joint ventures remain a common form of ownership and operating structure, providing strong capital funding and allowing access to banking markets for non-banking companies including retailers, transportation, energy companies and telcos. Those ownership affiliation in Thailand will be important in assessing each digital bank’s capabilities and strengths in the market.

Ascend Money and Ant Group

Ascend Money, a subsidiary of the influential Charoen Pokphand Group (C.P. Group), one of Thailand's largest and most diversified conglomerates, operates TrueMoney, one of the country's largest payment platforms. C.P. Group has interests in agribusiness and food, retail and distribution, telecommunications, e-commerce, and finance. Majority-owned and controlled by the Chearavanont family, one of the wealthiest families in Asia, it is known for investing heavily in technology and digital transformation. C.P. Group in partnership with Ant Group is seen as the largest threat to incumbent banks due to its significant market reach, technology capabilities and ability to disrupt the businesses of existing banks. True Money has more than 27 million users in 2023, 38% of market share. However, only 9% or 2.5 million account holders use its savings, investment and lending services.

If the consortium receives a licence, incumbent banks may face serious competition, particularly in the lucrative payroll and salary accounts, payments and cross-border remittances. In addition, CP Group’s substantial payroll accounts with the largest local banks may be at risk. Although both players offer well-established payment and financial platforms, if BOT and the Ministry of Finance choose not to grant this consortium a licence, or exclude Ant Group, it could be perceived as prioritising stability over competition, a decision which may face public scrutiny and dissatisfaction.

SCBX by Siam Commercial and KakaoBank

SCBX, the fintech and digital innovation arm of Siam Commercial Bank, is seeking to leverage KakaoBank’s innovation, technology capabilities, and proven digital strategies that have effectively challenged incumbents in South Korea. KakaoBank built its entire technology and infrastructure stack from scratch, using x86 Linus OS, Java language and open source-based data base management, which could enable this consortium to accelerate its operational readiness and launch within the stipulated 12-month timeframe. It is probably the most proven and competitive candidate for a licence, given the synergies between one of the leading retail banks in Thailand and a top digital bank in South Korea and Asia. KakaoBank has made significant inroads into South Korea’s retail banking industry since its launch in 2017, attracting one million users within its first month and achieving full fiscal year profitability in 2019, 30 months after launch in July 2017. By the end of 2023, it had 22.3 million customers, representing 43% of the population, a weekly active user base of 17.6 million and has captured 14% of total deposits in the market.

Jay Mart (JMart) and KB Kookmin Bank (South Korea)

JMart is a diversified retail business group in Thailand, best known for its retail operations and network of more than 200 retail stores that sell mobile phones and accessories. Beyond its core retail operations, JMart has expanded into other financial services, technology, and food services. Through its subsidiary J Ventures, it has developed the JFIN Chain blockchain and digital ecosystems like J Wallet and J Point, showcasing its capability to leverage technology for financial services. JMart’s strong presence in retail and expertise in financial services, position it well to offer digital banking services in partnership with Kookmin, the largest Bank in South Korea. Additionally, its 200 stores offer an added venue for cash in cash out transactions, further enhancing its digital banking proposition.

Gulf Energy Development, AIS, Krungthai Bank, and PTT Oil and Retail Plc (OR)

AIS, Thailand's leading telecommunications provider with a robust network and 45 million registered mobile users, is partnering with Krungthai Bank (KTB), and Thailand-based energy conglomerate Gulf Energy Development (Gulf) and PTT Oil and Retail Plc (OR). By combining AIS’s technological capabilities and vast user base, KTB’s financial expertise, Gulf’s technological and financial resources, as well as over 1,900 PTT gasoline stations across Thailand, this consortium would be well-positioned to enter the digital and retail banking sector. The Ministry of Finance’s 67% ownership of KTB adds a significant advantage to bid. As the largest consortium in the pool, this group is well equipped to assemble the necessary elements for a successful proposition, including customer loyalty and trust, rapid scaling, extensive data and touchpoints; and advanced technology capabilities. However, the complexity of aligning the diverse interests of the participants presents a formidable challenge.

BTS and partners

The BTS Group has established platforms like Rabbit Card and Rabbit Cash, which are widely used in Bangkok as the primary means of payment for the BTS SkyTrain and other public transportation systems that already integrate finance and digital services. Since its launch in 2012, the Rabbit Card has expanded its utility beyond transportation and is now accepted at numerous retail outlets, restaurants, and entertainment venues across Bangkok. With a strong brand reputation and experience in large-scale operations, BTS is well positioned to merge its existing services with digital banking. Additionally, VGI, a BTS subsidiary, plans to raise significant capital, ensuring financial readiness and compliance with the BOT's capital requirements. These factors make BTS a strong contender for enhancing financial inclusion and innovation in Thailand's banking sector. Although BTS’ partners are not yet known, it would benefit from collaborating with a financial service institution.

Other players that may have considered to participate

Additionally, Mitsubishi UFJ Financial Group (MUFG) and Krungsri Finnovate, Krungsri Bank’s fintech and venture capital arm, announced an investment of $195 million in Ascend Money, the digital payments and service provider operating TrueMoney, in July 2024.

As of now, Kasikornbank has not indicated any plans to apply for a digital banking licence. The bank has already developed strong digital customer service capabilities with its K-Plus mobile, the MAKE financial management application, which helps Thais to save and manage their money more effectively, and the LINE BK social media banking platform partnership – each of which already targets the potential segments that digital banks are aiming for.

More entrants in Asia

Thailand is not the only country in Asia to issue digital banking licenses or to open the doors to more licences.

In July 2023, South Korea's Financial Services Commission (FSC) began the process of allowing the country's fourth internet-only bank, after KakaoBank, Toss Bank and K-Bank, to enter the market. The publicly known contenders are all consortium-based bids, including Shinan Bank and Woori Bank among the participants. After more than seven years of operating in its home market, KakaoBank has expanded its reach through partnerships with Superbank in Indonesia and Siam Commercial Bank in Thailand.

In contrast, Hong Kong, which currently has eight digital banking licences, announced in August 2024 through the Hong Kong Monetary Authority that it will not issue further digital bank licences.

The majority of new digital banking entrants in 2024 and 2025 are expected to come from emerging markets in Southeast Asia, home to a population of 680 million people, where the unbanked and underbanked population remains significant. According to the World Bank, the combined emerging markets of Indonesia, Malaysia, Philippines, Thailand and Vietnam, have a financial inclusion rate of 69% (people with a formal banking or wallet account). indicating substantial opportunities for digital banks.

Thailand has 17 conventional banks providing retail banking services, resulting in a digital bank to banks with retail banking operations ratio of 0.18. In comparison, Singapore has a ratio of 0.33, with five digital banks, four operate with restricted digital banking licences with Trust, a subsidiary of Standard Chartered Bank, operates under a full banking licence, and 15 conventional banks offering retail banking services. Malaysia’s ratio stands at 0.24, with four digital licences and 17 banks in retail banking. The Philippines, which includes 26 universal and commercial banks offering retail banking services, excluding savings banks mostly owned by universal banks and over 350 rural and cooperative banks, has a ratio of 0.38, with 10 digital banking licences.

Tyme Group, a fintech headquartered in Singapore specialising in digital banking in emerging markets, is set to enter Vietnam in 2025 and Indonesia in 2026, following their successful launches in South Africa and Philippines in 2018 and 2020, respectively.

In the Philippines, the central bank, Bangko Sentral ng Pilipinas (BSP) will resume accepting applications for digital banking licences in January 2025 after a three-year moratorium, opening up an additional four digital bank licences. Potential bidders could include GCash, Revolut, and Wise.

Balancing stability and innovation

Thailand stands on the brink of a digital banking revolution with its first three digital banking licences potentially being issued as early as in the first quarter of 2025. This move aims to improve further access to banking in particular in rural areas where branch density is low, and to address the estimated $41 billion funding gap for SMEs. Despite a high formal banking rate, significant opportunities remain to serve the unbanked and underbanked segments in the population. Consortiums with leading Thai conglomerates are vying for these licences to offer a combination of advanced technologies, funding stability, and existing scale. However, many players see these licences as a constrain within the Thai context. As Thailand embraces this digital shift, regulatory considerations must strike a balance between stability and innovation to create a more inclusive financial ecosystem.

.webp)

.png)

_Webbanner.webp)

(1).webp)

.jpg)

.jpg)