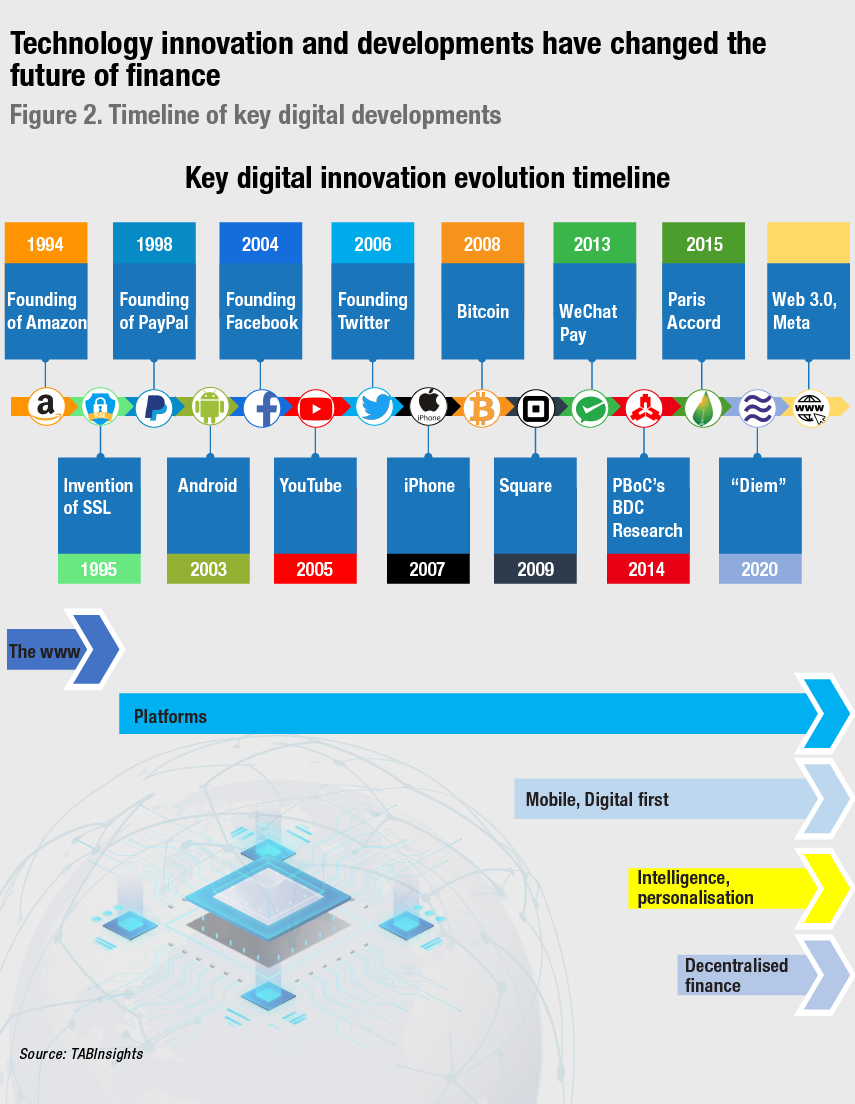

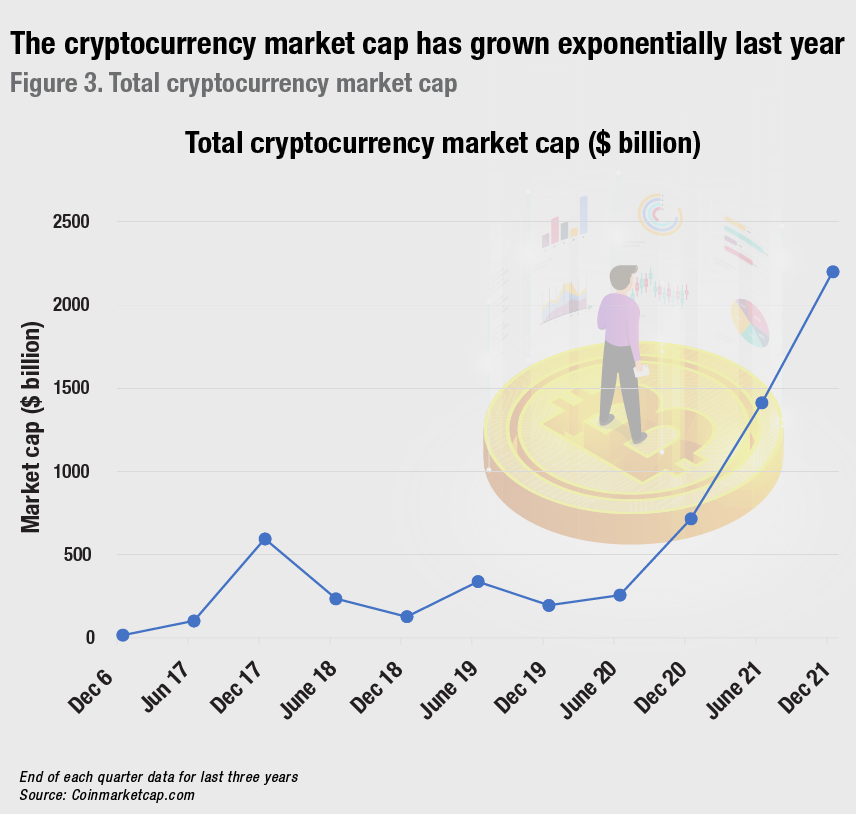

The internet has witnessed some major disruptions, from offering read-only, static content at its inception to much more more dynamic, interactive, and decentralised experience now.. Web 3.0 is evolving with , innovations in decentralised finance (DeFi), blockchain, cryptocurrencies, and distributed ledgers as its foundation. In December 2021, the total market capitalisation of cryptocurrencies stood at $2.2 trillion while the total locked value in DeFi protocols grew by over 1000% year-on-year.

The financial service industry is accelerating the adoption of Web 3.0.

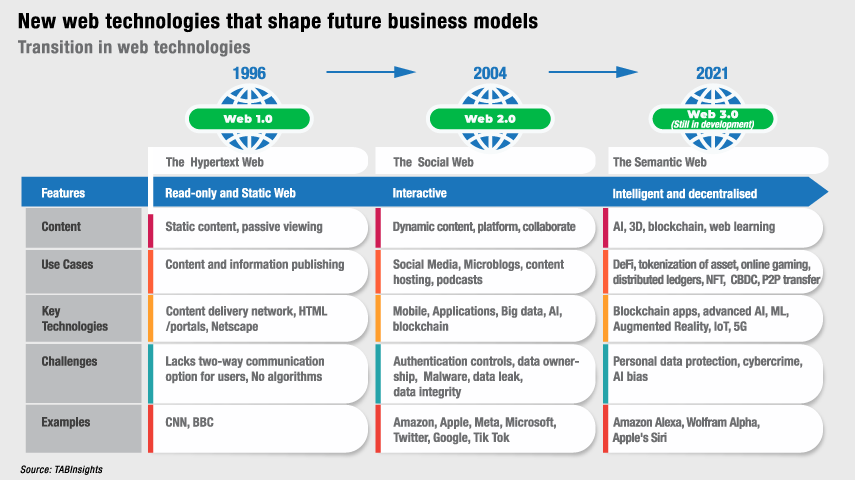

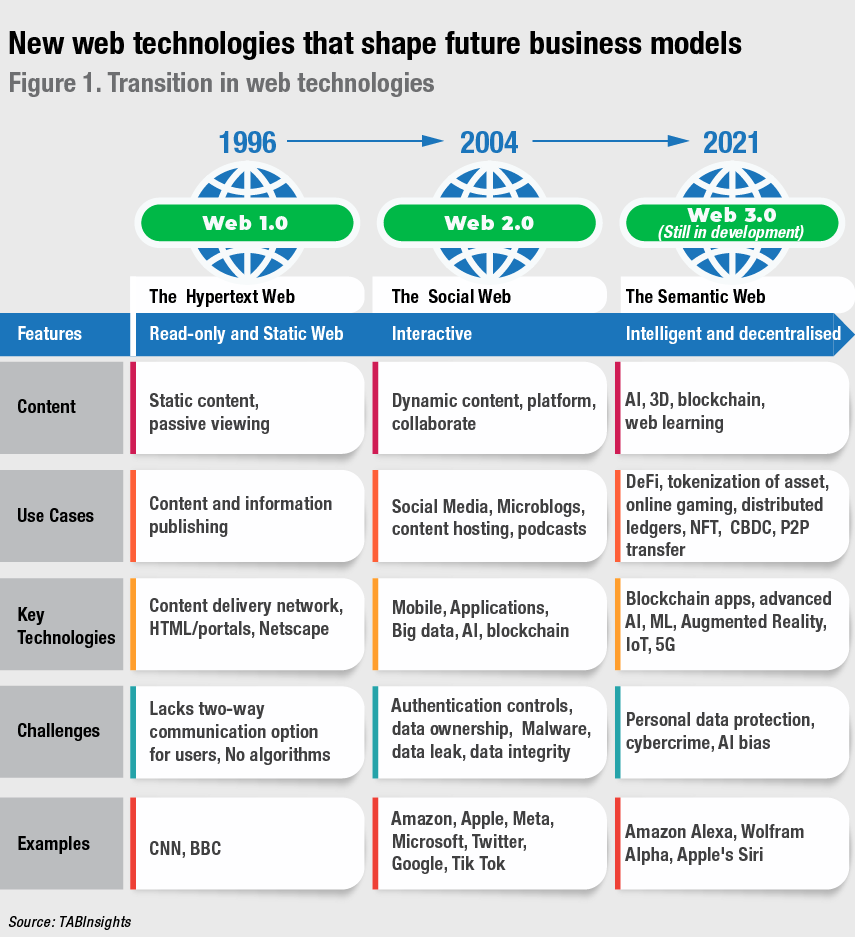

Internet technologies have constantly evolved over the last three decades. In 1990s, the first-generation Web 1.0 provided static content and information to users hosted on web servers. This was followed by an enhanced Web 2.0 also called ‘the Social Web’ that allowed users’ generated content, social media platforms, interactive capability and interoperability, but it also poses challenges with regards to data control and ownership. The next internet revolution that is still being developed is Web 3.0, also termed as the Semantic Web, which will be based on the convergence of emerging technologies like blockchain, artificial intelligence (AI), machine learning and augmented reality, among others. It will be characterised by decentralised data, a more transparent and secure environment, machine cognitive intelligence and three-dimensional design.

Web 3.0 and evolving landscape

In the last few years, the internet has been transitioning towards Web 3.0, which is focused on decentralised data that is more open, powered by distributed ledger technology (DLT), AI and machine learning (ML).

Web 3.0 is expected to see a convergence of multiple technologies including blockchain for better data ownership and control and DeFi. The ability to discern and evaluate information using AI and contextualised analysis could bring more relevant results, hyper personalised customer experience and better decision-making. The use of virtual and augment reality could power greater online and physical convergence, three-dimensional internet and interactive websites.

Financial and internet technologies have evolved rapidly, giving birth to new businesses. There is a growing need among institutions to innovate their services and business models and embrace these advancements that have the potential to reshape the future of money, payments and digital assets.

Singapore which is competing to be a leading global financial centre and technology hub sees innovations in emerging technologies such as blockchains and cryptocurrencies as essential enablers for the future of the industry. At fintech festival 2021 that it recently hosted, the impact of Web 3.0 on financial services was a key theme. It highlighted the emerging innovation that is reshaping the financial services business and operating models towards decentralisation, digital currencies, and advancement in AI, among others.

Heng Swee Keat, Deputy Prime Minister and Coordinating Minister for Economic Policies Singapore

Piyush Gupta, Group CEO, DBS Bank

Heng Swee Keat, deputy prime minister and coordinating minister for economic policies of Singapore, identified the three ways to maximise innovation. “First, by building momentum around technologies that can yield a step-change. Second, by creating the right market factors so that innovation can scale. Third, by doubling down on wielding innovation to improve lives,” he said at the fintech festival.

He cited various areas where AI can assist in social and economic developments and launched the National AI programme in Finance. It includes NovA! an industry-wide AI platform for financial risk insights, a collaboration between banks and fintechs in the country.

On top of the already announced SGD500 million ($365.8 million) budget, Singapore is setting aside an additional SGD180 million ($131.69 million) to accelerate the fundamental and translational AI research. “The potential for AI is huge, and it is critical to ensure that it is ethically used,” he added.

The adoption of Web 3.0 and technology developments have led the banks to evaluate and strategise for future business models and roles.

Piyush Gupta, CEO at DBS said that 5G is gaining relevance and the capacity to have both bandwidth and latency makes Meta world possible. He said blockchain enables proof of identity. The whole idea of self-sovereign identity is very relevant in the data-driven world. It gives proof of value for the customers and obligation for the banks and financial institutions. They are trying to chain the settlement paradigm of transactions. He challenged the more idealistic expanses of Web 3.0, which he referred as the third level or wild west. He pointed out that people do not need intermediaries or institutions and would pave the way for smart contracts.

“The problem with this argument is when you take it to the next phase you start questioning whether you need a central bank or you don’t need regulators. Even going as far as no longer needing a nation, state or government. It starts to become not a question of technology but of social politics and philosophy,” Gupta added.

Mike Wells, CEO, Prudential

Helen Wong, CEO, OCBC Bank

Mike Wells, group chief executive at Prudential shared that people will see much more data and consumers will have more control and implement customisation, however, they will need help. He discussed whether traditional banking is becoming redundant. He said that there is an element of disrupting traditional business that changes their role and capabilities, but not the value.

Helen Wong, group chief executive at OCBC Bank said that crypto is a storage value that comes with risk. She cited scams like the crypto token and how its value dropped. The name of the crypto was derived from the recent TV series, Squid Game.

“There are risks associated with transformation. It also comes down to the players. Are you able to get everyone together? It also becomes a trust issue of who will do the due diligence, eventually, it will rely on who is a trusted intermediary,” she said.

Data and AI-driven transformation in Web 3.0

The interconnected devices and expanded ecosystems, as well as data volumes that need to be aggregated and stored pose a real challenge for financial institutions. It is certain that data will be a critical asset that banks need to better monetise for future growth.

Jacquelyn Tan, Managing Director, UOB Singapore

Han Kwee Juan, Managing Director, DBS

Jacquelyn Tan, managing director and head of group personal financial services, Group Retail at UOB said Web 3.0 enables financial institutions to innovate their products and services. It enables them to keep up with the ever-changing consumer trends and provide hyper-personalised experience. It is imperative for the banks to not only invest in digital innovation but also transform consumers’ physical interaction to ensure seamless omni-channel banking. The ability to hyper-personalise the digital banking experience based on digital footprint by integrating consumer lifestyles brings the two-sided market together for a greater network.

Banks now need to rethink customer journeys with seamless convergence of key technologies, virtual reality and augmented AI to have more contextualised banking relationships.

Mark Smith, managing director at Digital Realty said as consumers expect a complete digital experience from the enterprise, there is a real necessity to aggressively leverage digitally-enabled interactions rather than physical interactions. Data localisation is gaining importance due to legal and regulatory policies to require local data storage. Singapore, Japan, Korea, and Australia have seen a strong data gravity intensity that doubles every year.

As data privacy rules gain prominence, consent-based aggregation of data can bring advantages. Singapore Financial Data Exchange (SGFinDex) initiative gives control and ownership of data to consumers along with the power to decide when to consent to share data. The Monetary Authority of Singapore (MAS) and the Smart Nation and Digital Government Group (SNDGG) recently launched the second phase of the SGFinDex which enables individuals to view the consolidated financial information of their investment at the central depository.

Han Kwee Juan, managing director and group head of strategy and planning at DBS said, “I am a true believer that technology will allow you to imagine anything, but you need an ecosystem to come together to solve a real pain point.” He said DBS has done experiments with 5G, IoT and is leveraging private cloud.

Open banking is gaining traction with a steady increase in application programming interfaces (APIs) and cloud banking adoption. This enabled merger of business goals and technology to create new commercial models. Banks no longer need to be monolithic and have started to specialise. The banking-as-a-service (BaaS) enables banks to focus on scale, openness and customer engagement.

Chuck Davis, commercial director at Temenos said banks and financial institutions adopt cloud and use software-as-a-service (SaaS) to move away from being infrastructure providers through APIs to create hyper-personalised customer experience. As a result, the industry players can scale and adopt faster to new market trends.

Kevin O’Leary, Chairman, O’Leary Ventures

Ravi Menon, Managing Director, Monetary Authority of Singapore

Growth of crypto, CBDC and next-gen payment systems

New companies building direct to consumer business models have shown significant growth. Kevin O'Leary, chairman of O'Leary Ventures said, “If you want to be part of the digital revolution, it’s all about using technology to enhance productivity. In financial services, that’s crypto. It’s a software that is making the financial markets globally more efficient, less friction and cost, more transparent and compliant”.

The total cryptocurrency volumes and market cap has surged in the last two years to peak at $2.83 trillion in November 2021. The year ended with market cap of $2.2 trillion. There are thousands of cryptocurrencies today with Bitcoin dominating the market having almost 39% share in the market cap.

Decentralised finance (Defi) refers to digital assets and financial smart contracts, protocols, and decentralised applications (DApps). Also based on distributed ledger and blockchain technology, Defi challenges the centralised financial system by disempowering the middlemen and focusing on peer to peer networks. The ‘total value locked in Defi’, which indicates how much money is currently working in different DeFi protocols, has increased significantly in the last two year.

The market is exploring the opportunities from blockchain technology and there is a growing need for compliant crypto use cases. However, DLT is still at the developmental phase and faces challenges such as interoperability, scalability and regulations that need to be addressed.

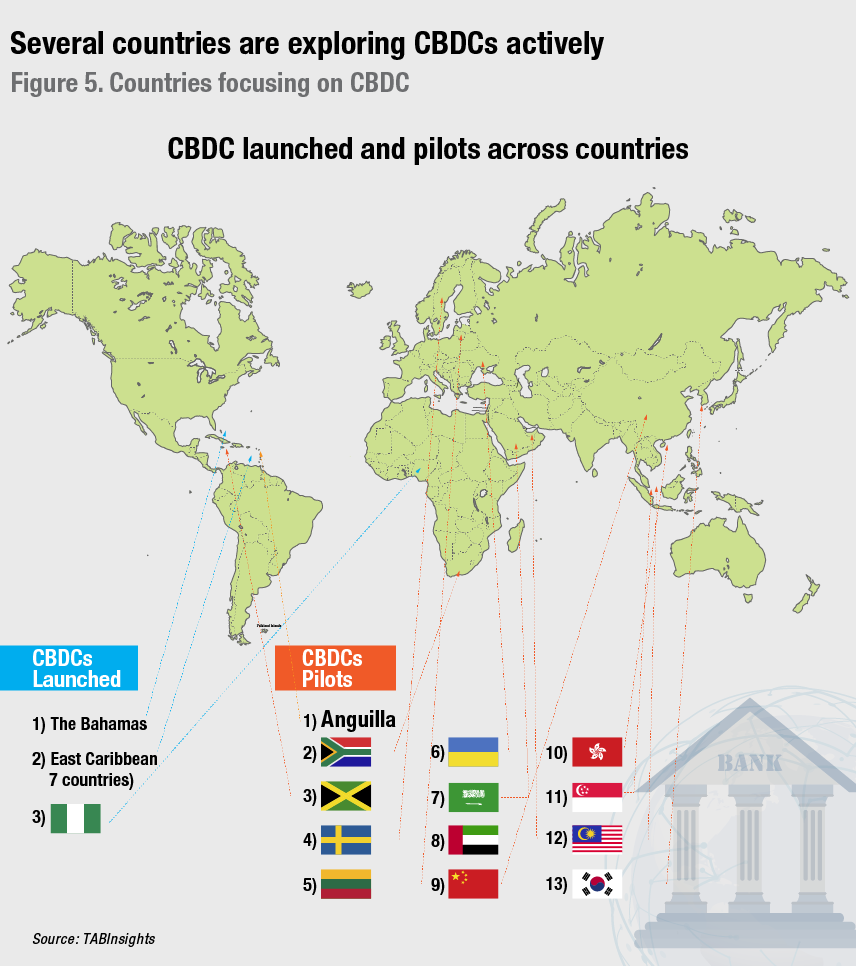

There are also regulatory concerns on cryptocurrencies, while many explore issuing central bank digital currency (CBDC). The Bahamas became the first country to launch a general purpose CBDC, known as the Sand Dollar, in October. So far nine countries have launched CBDCs including Nigeria and East Caribbean countries while 87 countries are exploring and testing the waters.

Ravi Menon, managing director at the Monetary Authority of Singapore (MAS) said the anonymity of crypto has made them well-suited for illicit transactions such as money laundering and fuel ransomware. “MAS frowns on cryptocurrencies or tokens as investments for retail assets. The prices of crypto tokens are not anchored on any economic fundamentals, and are subject to sharp speculative swings,” Menon said. He said blockchain and crypto tokens can bring many potential benefits such as faster and cheaper cross-border payments and trade finance, but they need to be more stable in value and have a credible backing. “MAS sees much promise in wholesale CBDC,” Menon said. However, there are neither strong reasons for or against retail CBDC in Singapore.

Countries are also exploring CBDCs for international payments. For instance, Project Dunbar brings together the Reserve Bank of Australia, Central Bank of Malaysia, Monetary Authority of Singapore and South African Reserve Bank with the Bank for International Settlements to test the use of CBDCs for international settlements. This experiment could make international payments cheaper and faster. However, such projects will need stronger participation from other countries, stronger governance and address challenges related to difference in regulations in different jurisdictions.

Serey Chea, Governor, National Bank of Cambodia

Michael Miebach, CEO, Mastercard

Serey Chea, assistant governor at National Bank of Cambodia and Patrick Njoroge, governor at Central Bank of Kenya discussed the public-private partnership, the potential uses of CDBCs and the need for greater collaboration. “We cannot do it alone. You need to be working closely with other like-minded institutions and central banks,” said Njoroge.

Meanwhile, the global payment landscape is evolving rapidly and there is a need to harness Web 3.0 to power the next phase of developments. Customers expect standards of speed, price, convenience or transparency in payment experience and banks need to build embedded payment as part of an integrated journey.

Michael Miebach, CEO of Mastercard said under Web 3.1, there needs to be seamless commerce. Payment needs to recede to where we do not see it and complete all needs intuitively. He pointed that the question of identity in seamless commerce is fundamental while digital identity is a game-changer.

Banks are exploring new models of embedded finance in payments. There is a need for greater public-private partnerships to maximise financial inclusivity. Cross-border payment needs greater collaboration and solutions to connect countries and regions. There are new bilateral arrangements that are emerging. MAS and the Bangko Sentral ng Pilipinas (BSP) signed an agreement to facilitate interoperable payments between Singapore and Philippines recently.

Marc Beniof, CEO, Salesforece

Oki Matsumoto, CEO, Money Group

Increased focus on trust and security

Marc Benioff, chairman and CEO at Salesforce said, “Nothing is more important than trust — the trust we have with all of our stakeholders, that is our customers, employees, partners, and public shareholders”.

The pandemic has resulted in greater convergence of physical and digital and the way we operate remotely. These have brought a greater focus on safety, digital identity, zero trust and security of data.

Web 3.0’s decentralised architecture addresses the issues such as user trust, privacy, and transparency by integrating blockchain networks of decentralised nodes that can validate cryptographically secured transactions. As a result, consumers do not need to rely on a single centralised entity.

Oki Matsumoto, CEO at Money Group said Web 3.0 is a trusted network that can create a new nation in cyberspace. It has a variety of ways of doing business in this nation like the introduction of smart contracts. A smart contract is decentralised app that executes business logic in response to events. Its execution can result from the transaction of funds, delivery of services, unlocking of content protected by digital rights management, or other types of data manipulation. It can be used to enforce privacy protection by facilitating the selective release of privacy-protected data to meet a specific request.

The discussions also highlighted the need for governance of AI, managing models and security of data.

Ben King, chief security officer, APAC and EMEA, Okta

Ben King, chief security officer for Asia Pacific (APAC) and Europe, Middle East, and Africa (EMEA) at Okta said in an interview, “We will see more ‘zero trust’ and using that in how we structure security programmes. We will see more reliance on multi-factor authentication. It is probably the single strongest control we have to secure what we do, and we will see more application of password-less.”

There is a growing application of ML to analyse large data sets in security. As attackers use ML, we need machines that can respond in seconds. “This is a rapidly growing debate because you can lose a human in the loop if the machine is combatting another machine,” King said.

The cycle of change is undoubtedly constant, but its speed has certainly accelerated during the pandemic. Going forward, Web 3.0 and transition towards decentralisation, digital currencies, ability to monetise data effectively and stronger ecosystem collaborations for customer-centric service will continue to drive the evolution of the financial services industry.