Industry picture

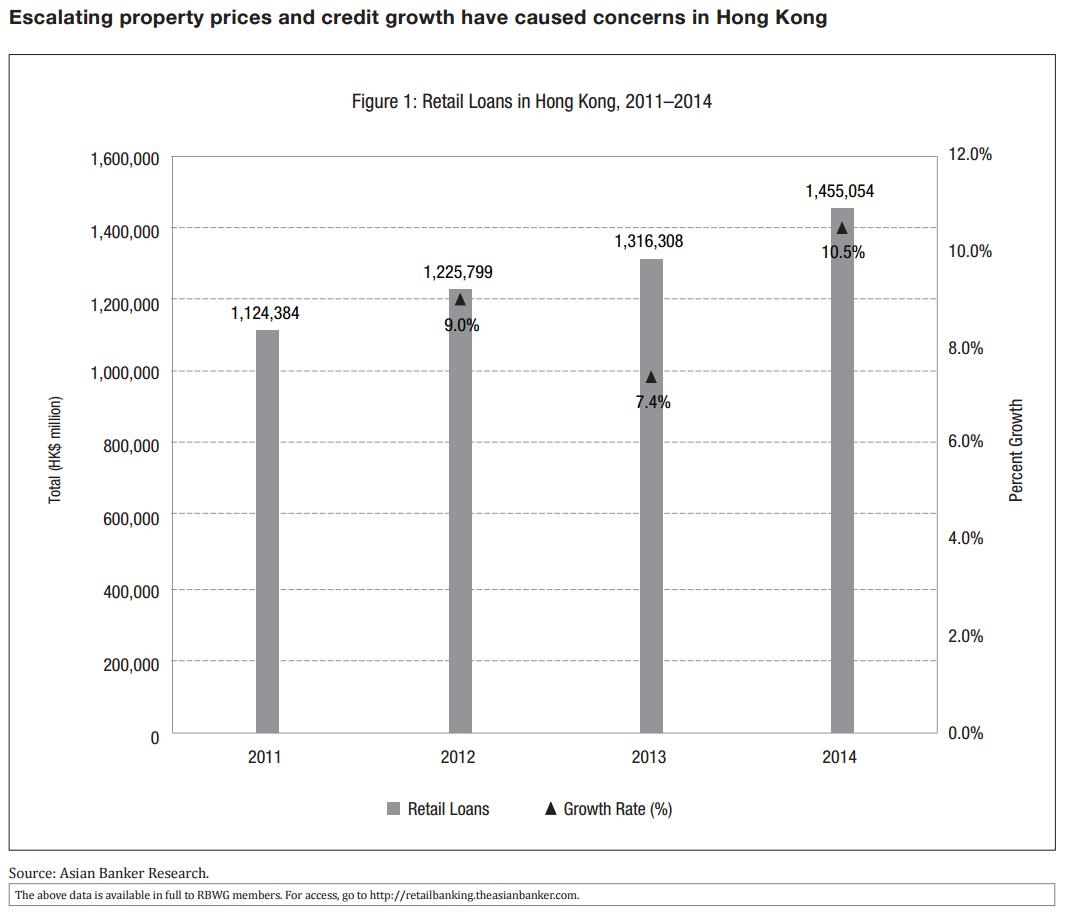

Retail banking in Hong Kong has displayed strength in a relatively mature economic environment, with a well-performing regulator and low susceptibility to potential risks. However, escalating property prices along with credit growth have caused concerns. Due to low interest rates and robust demand for personal property from mainland China, property prices have risen in Hong Kong since 2010. The Hong Kong Monetary Authority (HKMA) implemented new regulations in the second quarter of 2014 governing personal loans, debt-service ratio (DSR), and loan tenure over concerns that the current household debt-to-GDP ratio may rise to a significantly higher, and potentially unsustainable, level in the event of an economic downturn. Retail loans in Hong Kong experienced accelerating growth in 2014. Our research showed that there was a 10.5% increase in total retail loans outstanding compared to a 7.4% growth rate in 2013, reaching a total of HK$1455 billion ($188 billion) in 2014 (Figure 1).

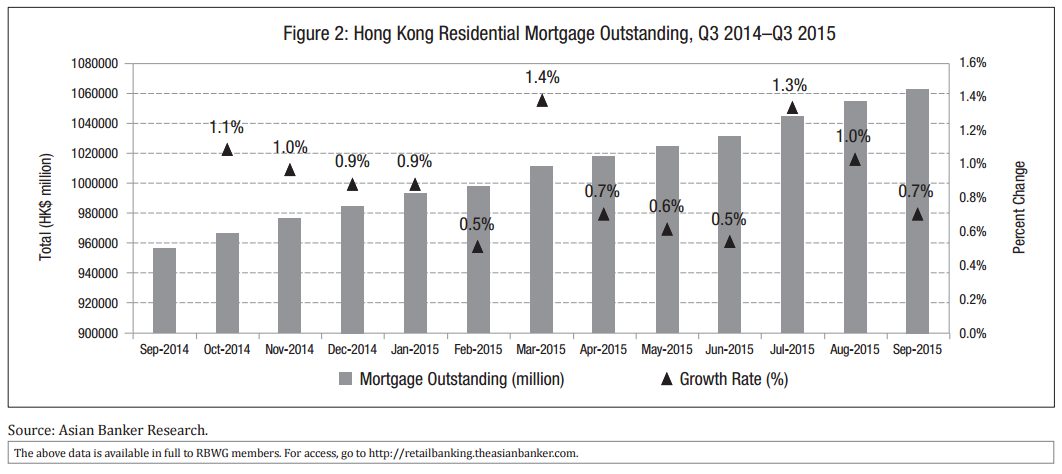

In February 2015, Hong Kong regulators continued placing controls to confront the risks in Hong Kong’s active property market. HKMA announced three more tightened countercyclical measures including lowering the maximum loan-to-value (LTV) ratio for self-use residential properties with value below $902,872 by a maximum of 10 percentage points to 60%. With these cooling measures, outstanding mortgage in February–June 2015 posted slower growth except in March, which displayed a surge as a result of temporary increases in IPO loans. Nevertheless, by July, the volume of transactions in the property market rebounded (Figure 2).

We selected two Hong Kong domestic banks, Bank of East Asia and Hang Seng Bank, to analyse their recent retail business and retail lending

Bank of East Asia

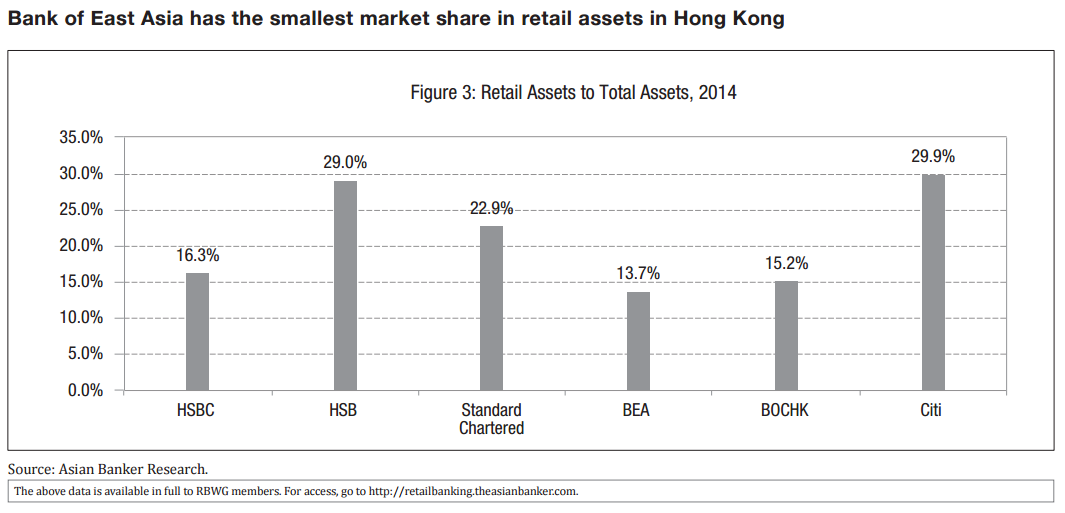

Bank of East Asia (BEA) has the smallest operations in retail banking compared to its competitors in Hong Kong (Figure 3). BEA’s retail assets accounted for 13.7% of total assets in 2014 compared to that of Bank of China Hong Kong (BOCHK) at 15.2%, HSBC at 16.3%, Standard Chartered (SCB) at 22.9%, and Hang Seng Bank (HSB) at 29%. The figures reflect tepid growth in BEA’s retail banking segment, as it focuses more on corporate banking, treasury management, and offshore operations in China, Macau, Taiwan, as well as the United States, wherein it has more than 30 branches.

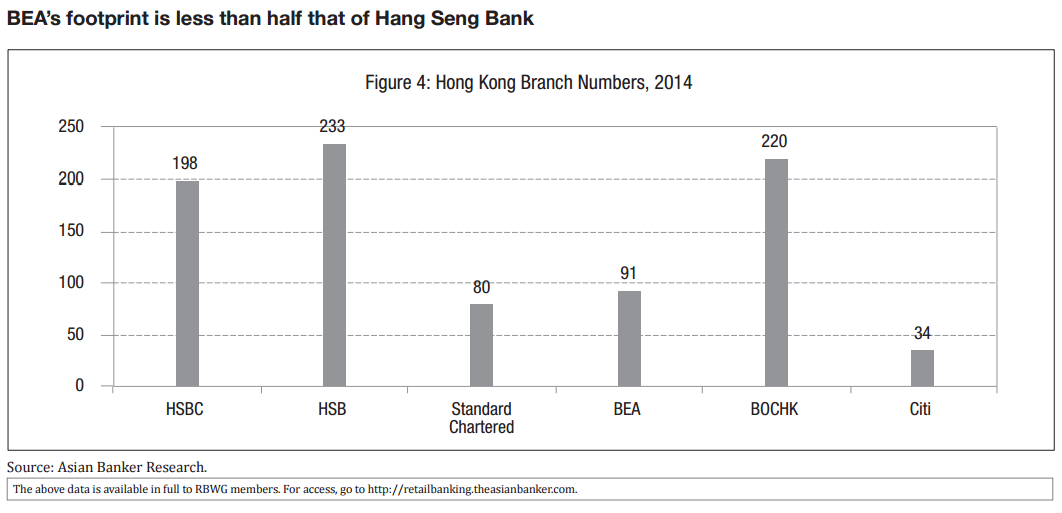

Despite having the third largest network of 226 ATMs in Hong Kong, BEA only has 91 branches in the country, placing it fourth among its competitors (Figure 4). People in Hong Kong are looking for convenience in terms of cash withdrawal and account opening, so BEA’s fewer branches against big players like HSBC (198 branches), BOCHK (220 branches), and Hang Seng Bank (233 branches) contributed to its modest performance in the segment (Figure 4). In terms of international financial services like cross-border remittances, although the bank is performing well, big banks like SCB and Citi can easily eclipse its worldwide services.

In terms of retail lending, BEA places 6th among its competitors. This can be attributed to two reasons: first, customers tend to confine their banking needs and transactions in banks where they already have accounts; and second, most Hong Kong borrowers still prefer to go to branches to apply for retail loans, because they seek advisory assistance despite the availability of digital banking services for loan applications. Moreover, borrowing limits are placed when using digital channels.

BEA has to strengthen its presence locally and globally through various banking products and services if it hopes to be a key player in the retail banking business.

Hang Seng Bank

As a result of the partnership between Hang Seng Bank and HSBC Holdings, which owns 62.1% of Hang Seng Bank, cost-saving synergies and access to HSBC’s vast network and distribution channels, particularly in mainland China markets, are benefitting Hang Seng Bank. In 2014, gross retail loans and advances to customers grew by 10.4% to $25.9 billion, compared to $2.44 billion at the end of 2013.

Hang Seng Bank was able to maintain its market share in the mortgage business, posting a growth in residential mortgage lending to individuals of 9.3% in 2014 compared to 2013, thanks to its comprehensive product suite. Credit card advances increased by 12.9%, and other loans to individuals grew by 18.1%, reflecting the success of Hang Seng Bank in expanding its consumer finance business.

Hang Seng Bank is ranked the 6th strongest bank by balance sheet as of 2014 in The Asian Banker 500. Its massive size, as shown by a balance sheet containing over $129 billion in assets, allows various opportunities to leverage resources and limit expenses. For instance, the group is able to disperse its operating expenses over a greater range of revenue streams, and deploy sufficient capital to acquire and integrate peripheral businesses, resulting in a vertically integrated structure. Additional cost savings are generated through the group’s strategic partnership with its parent company, including customer access to Hang Seng Bank accounts via HSBC’s vast ATM network. Through collaboration and cobranding with its parent company, Hang Seng Bank is able to develop its credit card business, which accounts for 20.2% market share, second only to HSBC. However, the bank has a relatively small share of mortgages as it tries to maintain a conservative capital position (its capital adequacy ratio is 14%).

Loans and advances outside of Hong Kong rose by 20.5% in 2014, compared to end-2013, partly driven by lending in mainland China. Lending by Hang Seng Bank increased by 6.7% to $8.4 billion, underpinned by the expansion of Renminbi lending to corporate and commercial customers as well as residential mortgages. The bank employed a cautious approach to lending in the mainland and will continue to strengthen its prudent credit policies in light of the more challenging credit environment in the mainland.

Hang Seng Bank has always been vigilant in compliance in the face of stringent regulations. It has achieved a capital adequacy of 14% and Tier 1 capital ratio of 10.5%. In 2015, the bank twice sold its share in China’s Industrial Bank, in February and May, for a total worth of about $4.64 billion, to bolster its capital position and fund expansion as it sought to expand its services and exposure in China.

Slower but positive growth in retail lending in Hong Kong

Industry observers believe that the current household debt level is not alarming (Figure 4). We believe some banks have implicitly marketed personal loans as an alternative to mortgage loans given tighter LTV requirements over mortgage loans. Hence, the HKMA is tying up loopholes. In January 2014, the HKMA enacted new regulations requiring authorised institutions to adopt more prudent underwriting standards on personal loans, which includes establishing DSR limits, conducting internal stress testing, and reducing the issuance of longterm personal loans. These regulations have proven effective even as the growth of lending has outpaced deposits, with a higher LTV ratio of 72.2% posted at end-2014, compared to 70.3% in 2013. For instance, Bank of East Asia’s LTV ratio climbed from 70.1% in 2013 to 74.8% in 2014.

As a result of these stricter regulations, the asset quality of Hong Kong banks is not a concern. Given the strong growth of and demand for retail loans, we believe the biggest challenge for consumer loans in Hong Kong lies in pricing rather than asset quality. Nevertheless, the fierce competition in Hong Kong’s banking industry may hold back pricing increases in loans.

Card payments have continued to rally and have become one of the most important payment methods in Hong Kong, thanks to the popularity of POS terminals. Credit cards alone account for 51.7% in terms of transaction value, while demonstrating a compounded annual growth rate of 5.23% during 2009–2013 in terms of card numbers. On the other hand, debit cards took up 40.9% of transaction value. Growth in transaction value is forecasted to be 2.45% for credit cards and 1.31% for debit cards.

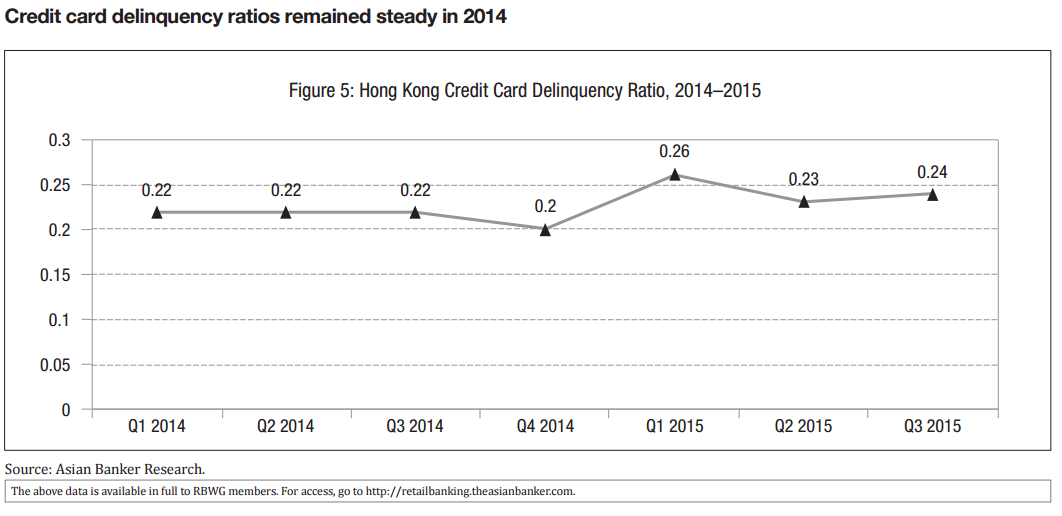

The delinquency ratio of credit cards remained steady during 2014 at about 0.2%, but a spike of 0.26% was seen during Q1 2015 (Figure 5). Coupled with severe competition, the fast expansion of the credit card business may lead to loosened compliance and higher credit limits. For instance, impairment charges in Hang Seng Bank and BEA rose by 113% and 116%, respectively, in 2014, which showed worsening credit among borrowers. In addition, with stock market volatility having rocked Hong Kong and China this year, banks should take a closer look and examine their clients’ credit history and financial condition.

To sum up, although the newly enforced regulations impose stringent requirements for mortgages and personal lending, consumer credit is still expected to be stable in 2016. Slower but positive growth is expected as customers become accustomed to the new regulations. Also, Hong Kong’s economy is relatively sound. Banks should customise their products and services to win customers under the new regulations regime and in the face of competition from bank and nonbank players, while maintaining vigilance on credit verification and examination.