- Data consolidation leads to better insights

- Unified technology platform can simplify AI deployment at scale

- Regulations are in place to ensure models are ethical, explainable and transparent

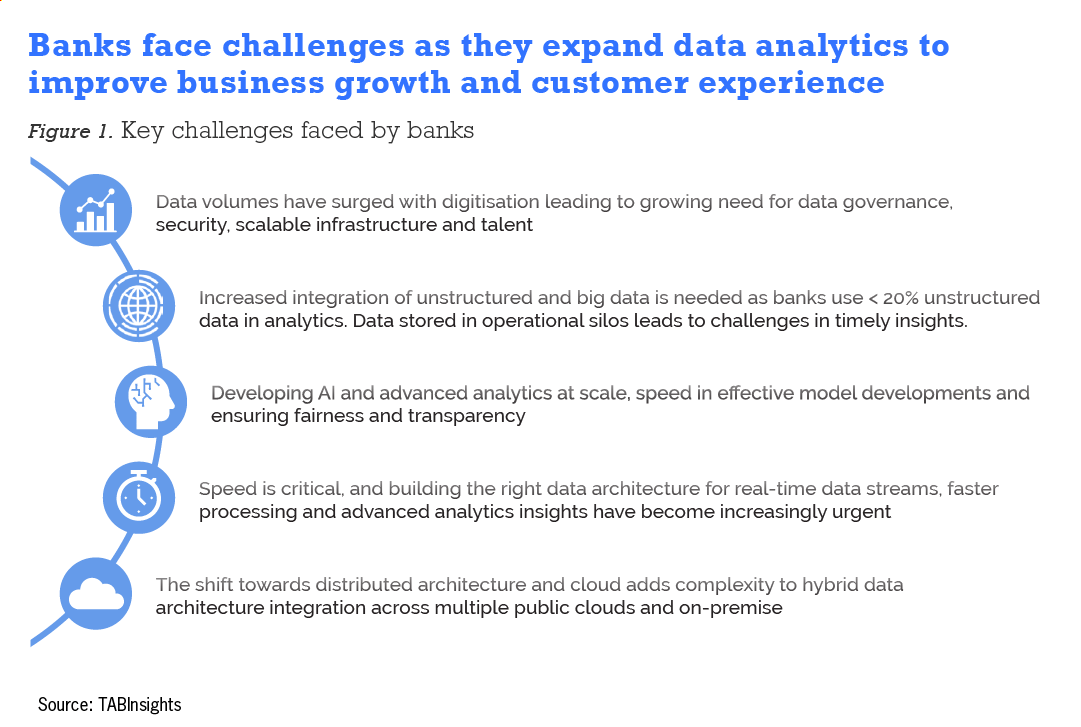

Banks are increasingly relying on artificial intelligence (AI) to arrive at informed decisions, improve operational efficiency and personalise customer service. As banks strive towards data-driven capabilities, adopting AI and advanced analytics has been rated as the top challenges faced by five out of seven banks, based on a survey conducted by The Asian Banker.

Banks will need a clear vision for an advanced analytics-driven organisation to address emerging challenges in AI adoption. They will need to rethink key building blocks to operationalise and optimise AI across the institution.

Data consolidation leads to better insights

Advanced analytics demands a reassessment of key foundational elements. Banks need futuristic data architecture to drive data for business and scale. The urgent priority should be data unification and the ability to integrate data silos across systems for better insights. Banks increasingly seek partnerships and ecosystem data, as well as the ability to incorporate real-time data streams through application programming interfaces (API). Banks face challenges in expanding unstructured data into analytics.

As hybrid distributed systems emerge, financial institutions also need to prepare for the rising complexity of architecture across multiple clouds, on-premise and edge. The integration of API is enabling faster information and insight flows across systems.

Banks should reconsider their processes across the organisation, including data governance, workflows and customer-facing processes. These would allow banks to embed insights into products and services to provide faster, personalised and streamlined products across channels and applications in new business use cases.

Another challenge is making insights more consumable for business and having production-ready predictions that can be incorporated into products in real time. This will need seamless integration with existing workflows.

The AI and machine learning (ML) development process is often complex, entailing data preparation, model creation and training, as well as validation, implementation, and embedding insights into the organisation. Banks must train and iterate models multiple times to ensure effectiveness and higher prediction and accuracy rates. Advanced models use deep learning based on neural networks and knowledge graphs to organise data from multiple sources.

Data privacy remains a concern among banks. Federated learning is an emerging technique that is gaining adoption among banks. It allows banks to train AI models on decentralised data, protecting data privacy, without sharing data.

Unified technology platform can simplify AI deployment at scale

Banks should move towards a unified technology platform for model development to shorten and simplify the process and improve cost-efficiency and agility. Machine learning operations features have the potential to automate and streamline development pipelines, scale ML models, and reduce costs.

Going forward, low-code or no-code data science is likely to be critical for deploying AI at scale. Low-code AI platforms include using graphical user interfaces and drag-and-drop tools to allow business and non-technical users to create AI using prebuilt components. The Asian Banker’s survey shows that 60% of FI prefer pre-built ML capability for fraud prevention.

Banks must balance the ease of AI development with explainability and transparency. A key and growing concern is AI model bias and fairness, as well as greater transparency in the AI decision-making process.

Regulations are in place to ensure models are ethical, explainable and transparent

Regulators including the Financial Conduct Authority in the UK, the European Securities and Markets Authority in the EU, and the Securities and Exchange Commission in the US have issued guidance on the use of AI in financial services. These include directives around ethical considerations, explainability, data protection, and algorithmic bias. The Monetary Authority of Singapore also issued guidelines on principles of fairness, ethics, accountability and transparency when deploying AI.

To gear for all these scenarios, banks will need to plan for the right AI expertise and skill set, especially for data scientists and technical staff. Banks must reskill business staff for evolving roles in an analytics-driven organisation.