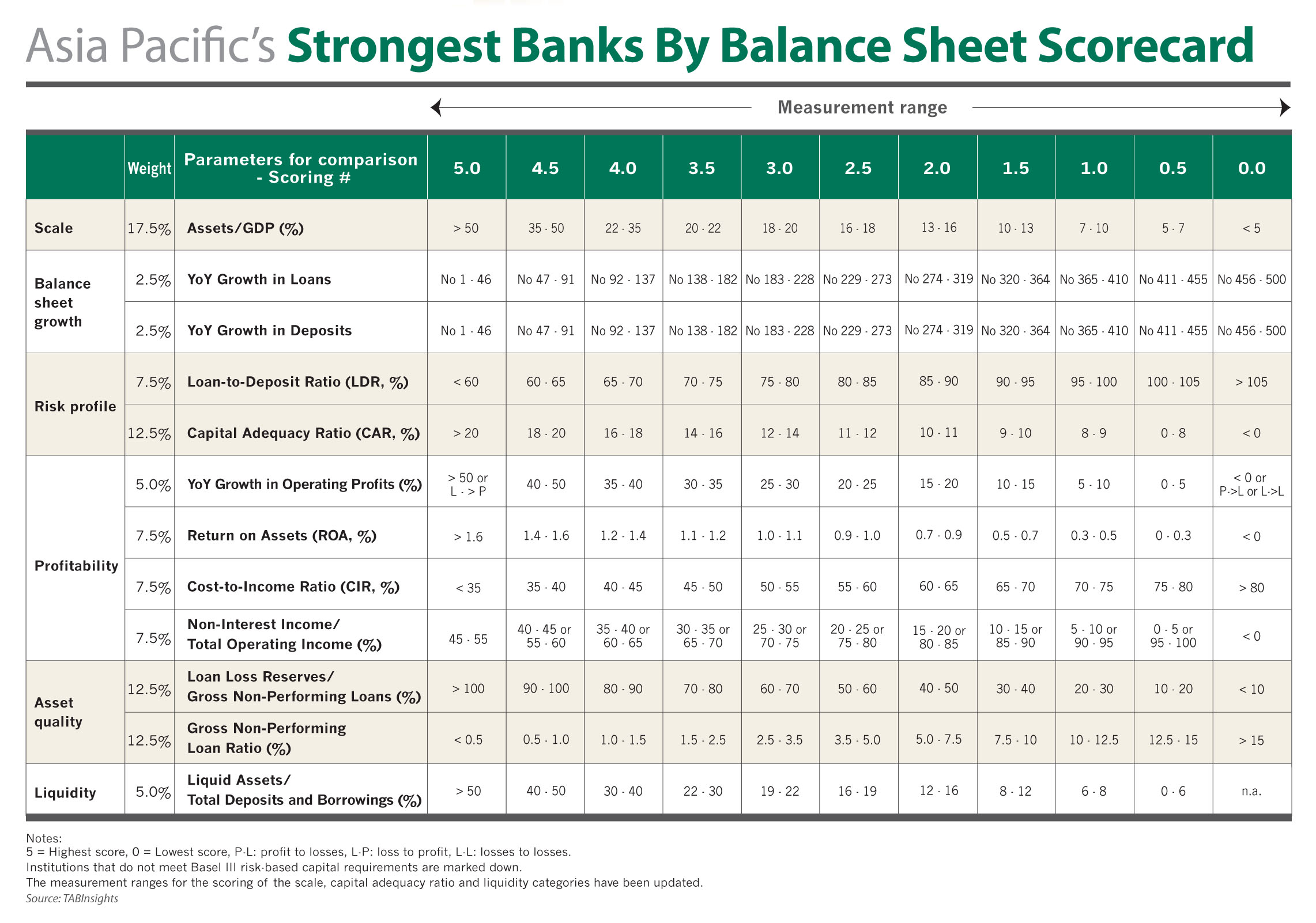

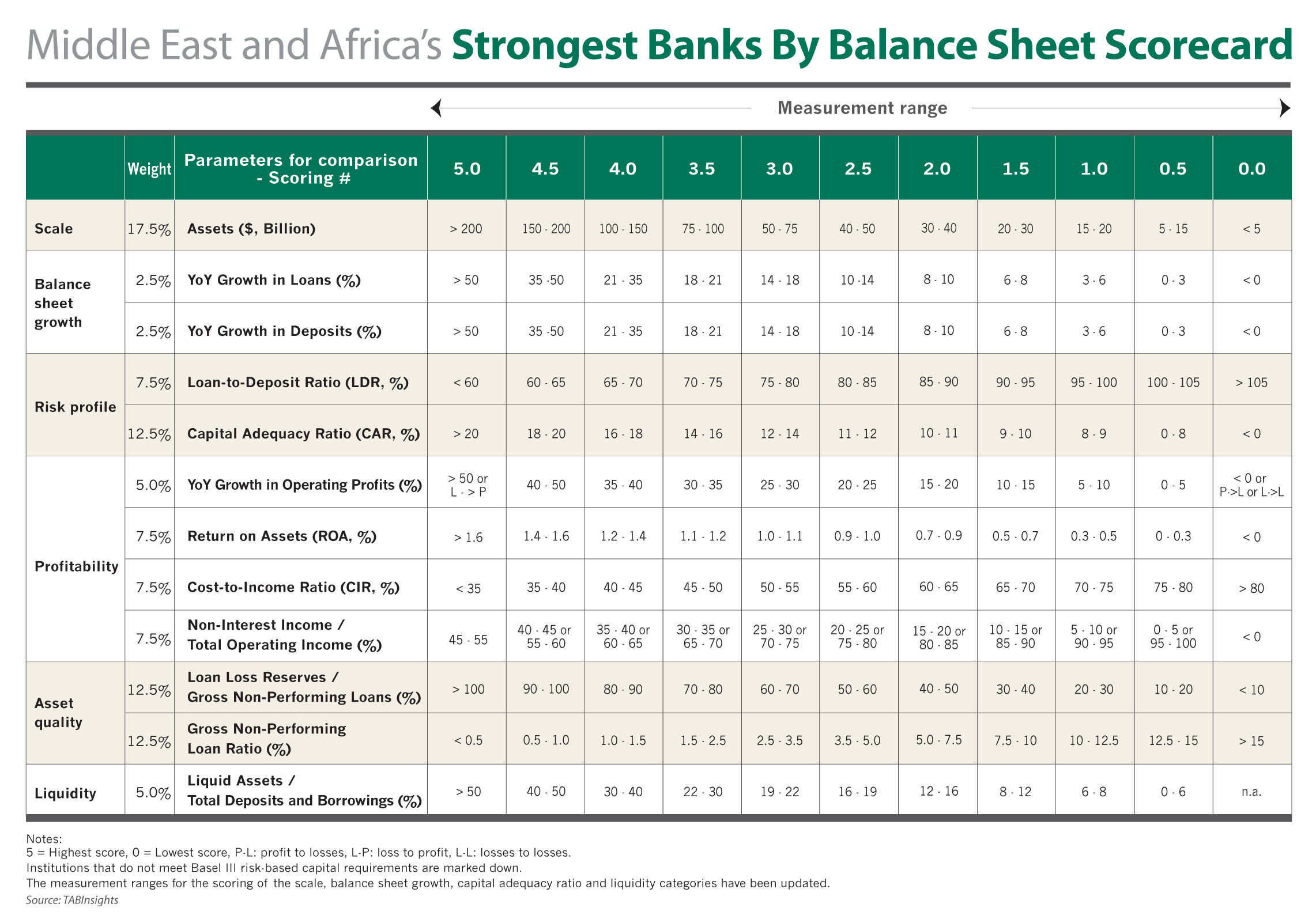

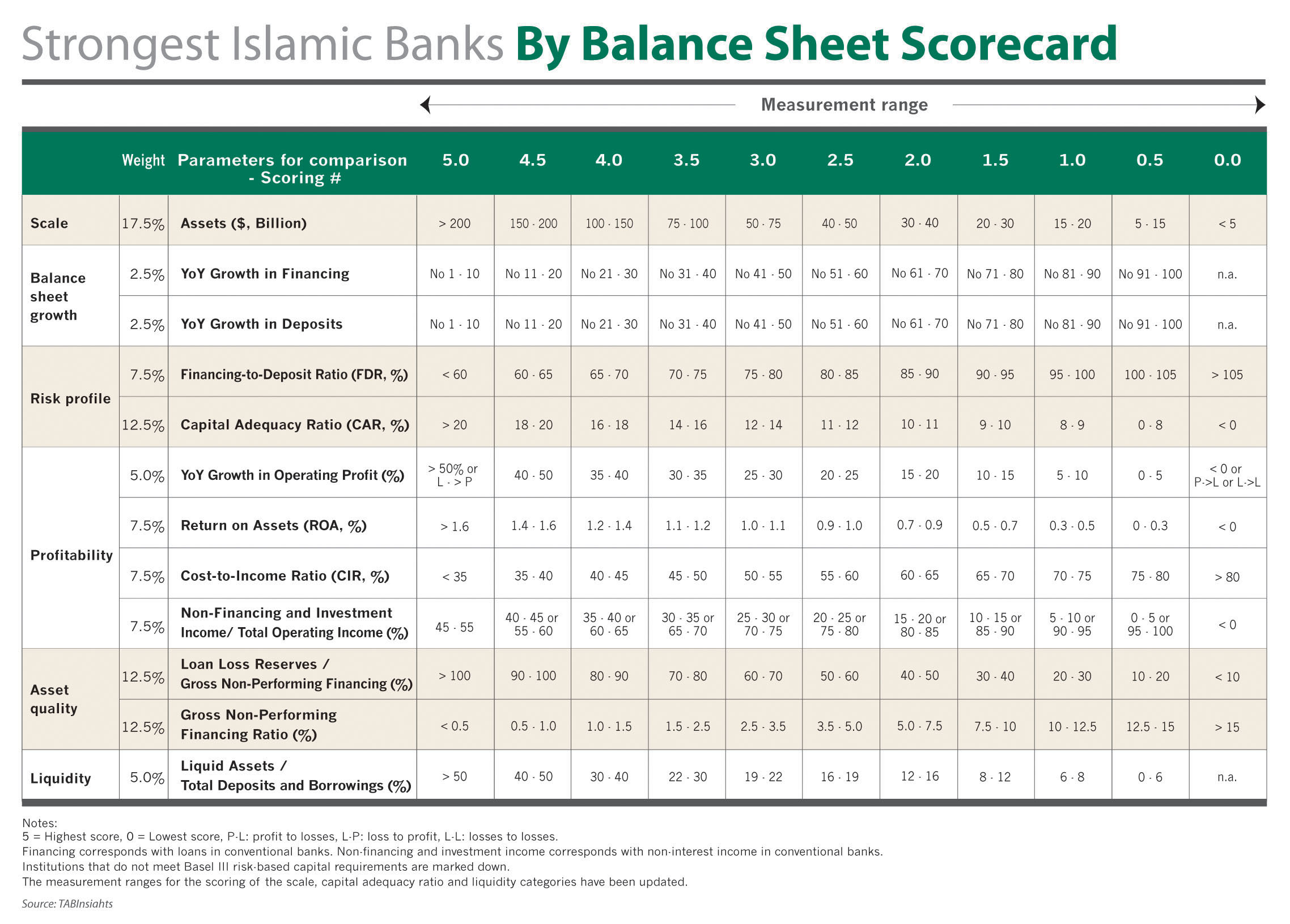

The Asian Banker has been publishing the world’s first authoritative annual ranking of the Strongest Banks in Asia Pacific since 2007 based on balance sheet strength. It uses a detailed and transparent scorecard to evaluate the ranking which entails six areas of balance sheet financial performance: the ability to scale, balance sheet growth, risk profile, profitability, asset quality and liquidity. The ranking has since been expanded to include banks in the Middle East, Africa, and Central Asia as well as Islamic banks globally.

The ranking supports counter-party banks and corporates in looking into the quality of the institutions under our coverage, for credit, transactional and trade purposes. The strength rankings are especially useful for augmenting assessment criteria for counter-party and balance sheet risks. The ranking provides a bird’s eye view of the institutions’ balance growth and profitability against the vagaries of economic conditions.

The assessment covers both banks and financial holding companies with significant activity in commercial and transaction banking. The evaluation does not include central banks, policy banks or finance companies.

The countries and regions covered in the Strongest Banks across the Asia Pacific include Australia, Bangladesh, Brunei, Cambodia, China, Hong Kong, India, Indonesia, Japan, Kazakhstan, Laos, Macau, Malaysia, Mongolia, Myanmar, New Zealand, Pakistan, the Philippines, South Korea, Sri Lanka, Singapore, Taiwan, Thailand and Vietnam.

The countries evaluated in the Strongest Banks in the Middle East include Bahrain, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE).

The countries assessed for Strongest Banks in Africa include banks and financial holding companies in Algeria, Egypt, Ghana, Kenya, Mauritius, Morocco, Nigeria, and South Africa.

Our rankings for Strongest Banks in China are done by provinces and bank categories, including strongest big four banks, strongest national joint-stock bank, strongest provincial bank, strongest city commercial bank, strongest rural bank. More countries will be added as we expand coverage.

The Evaluation Criteria

This evaluation criteria were set based on a rigorous quantitative assessment of the financial performance of banks in the regions we cover during the year under review. We evaluate performance through six crucial indicators weighted by their relative importance: (1) Scale of the banks’ assets relative to domestic gross domestic product (GDP), (2) Balance sheet growth of net loans and deposits, (3) Risk management of the banks’ operations, (4) Profitability and its sustainability, (5) Strength and credibility of loans disbursed and (6) Liquidity of assets to meet adverse events requiring cash outflow.

To access the rankings of Strongest Banks by Balance Sheet please click here